Lending & Credit

Singapore banks stomach larger asset quality risk in overseas pivot

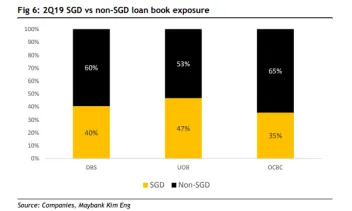

OCBC's non-SGD loan book exposure hit 65% in Q2.

Singapore banks stomach larger asset quality risk in overseas pivot

OCBC's non-SGD loan book exposure hit 65% in Q2.

Will regional bank distress threaten China's fragile financial stability?

Failure at the regional level may squeeze funding options for the NBFI sector.

Which Singapore bank has the highest unsecured NPA?

This lender has more than half of its bad assets unsecured.

Here's what delays the recovery of Indian banks

Troubled finance companies will hold banks back.

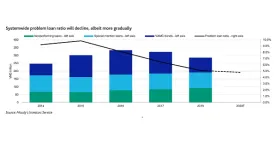

Vietnamese banks' problem loan ratio to fall to 4.8% by 2020 as lenders wipe slate clean

Most banks are expected to fully write off bonds from VAMC.

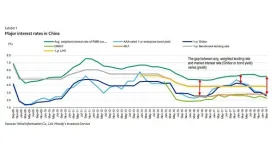

New prime rate mechanism poses risk to Chinese bank profitability

With narrower loan margins, some banks may turn to riskier activities to boost earnings.

Rising risks hit Indian banks as regulators call to save NBFIs

The defaults of Infrastructure Leasing & Financial Services and Dewan Housing has investors spooked.

ASEAN banks perform poorly in environment sustainability survey

However, banks in Singapore outperformed their peers.

Thai banks' bad loan balance hits 1.8% in Q2

Weaker debt servicing abilities reflected the slowing economy.

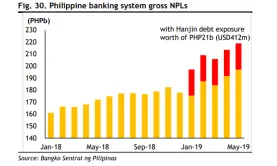

Can Philippine banks ride out the bad loan wave?

Systemwide non-performing loans rose sharply by 22.5% in January.

Taiwanese banks' loan book hit $940.4b in May

Loans granted by local banks grew $357.6b in May YTD.

Singapore banks' NIM expansion could hit 1-2bp in Q2

Both OCBC and UOB could have a NIM expansion of 2bp during the period.

Thai bank loans could grow 7% by end-2019

It will be supported by government projects paired with private investments.

Hong Kong banks' loan growth rose 3% in May

HKD loans were buoyed by mortgage demand.

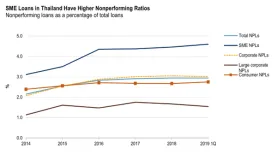

Chart of the Week: Thai banks' bad loan ratio hit 3% in Q1

SMEs’ bad loan ratio continued to grow from 4.4% to 4.6%.

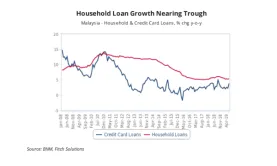

Chart of the Week: Can households buoy Malaysia banks' loan growth?

The sector makes up 5.7.8% of the total loans.

Banks cash in on Vietnam's micro-consumer loan segment

The sector’s interest rates could exceed 50% per year.

Advertise

Advertise