Can Philippine banks ride out the bad loan wave?

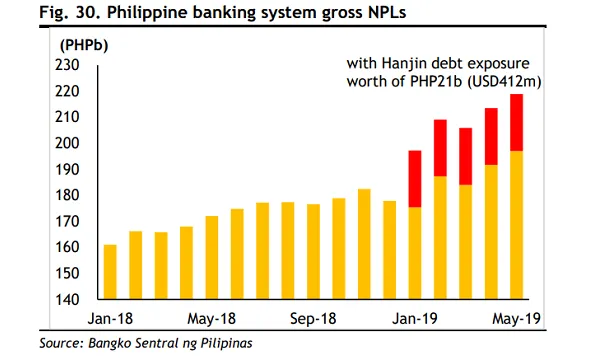

Systemwide non-performing loans rose sharply by 22.5% in January.

After a sharp spike in non-performing loans (NPL) in January following the sector's massive $412m (PHP21b) exposure to troubled Korean shipbuilder HHIC-PH, banks in the Philippines are regaining their footing with NPL levels stabilising and witnessing flat growth at 14.5% in May, according to Maybank Kim Eng.

Also read: Bloated corporate loan books drag down Philippine banks

After HHIC-PH filed for a voluntary rehabilitation, creditors agreed to work together and participated in a debt-to-equity swap. About 36% of total debt valued at $149m were converted into a 20% stake in HHIC-KS. In a breakdown, BDO and BPI converted 42% and 38% of their respective debt into 3.40% and 3.10% stake. LandBank coverted 46.5% of its debt for 5.00% stake and RCB converted 45.3% of its debt into 8.50% equity.

"We believe this gives participating banks another option to recoup their debt once HHIC-KS’ share price improves. PH banks can start liquidating in 2020, after a holding period until end-2019," analyst Katherine Tan said in a report. "We also expect NPL to go down as debt exposure gets reclassified to equity investments and placed under nonperforming assets."

Also read: Philippine banks' bad loan ratio to hold steady at 3.5% in 2019

The bad loan situation is also stable on the consumer side with NPL ratio holding steady at 4% in Q1. NPL growth also slowed to 11.3% from 12.8% in the previous quarter following slower growth in bad loans from the auto segment which offset a mild increase in mortgage NPLs.

"Our 2019 forecast already assumed a rise in the banks’ NPLs in view of the HHIC-PH exposure and rising rates. Provision expenses are also expected to increase by 19% YoY resulting in a 2bps rise in credit cost," added Tan.

Advertise

Advertise