Lending & Credit

China lets banks waive bad loans from COVID-hit firms

Qualified businesses can apply for delays until end-Q2.

China lets banks waive bad loans from COVID-hit firms

Qualified businesses can apply for delays until end-Q2.

CIMB Singapore announces new measures for coronavirus-hit firms

Tourism-related firms are eligible for a $1m loan with a 5% interest rate.

Chinese banks' latest LPR cut to derail NIMs, profits

Loan prime rate dropped 10 basis points to 4.05% on February 20.

DBS converts $758m bank guarantee facility into green facility

Wind turbine maker Siemens Gamesa will issue green guarantees under the facility.

DBS Group prices $1.4b issue at 3.3%

The deal is said to bear the lowest coupon for any AT1 USD deal in the world.

MUFG prices world's first ESG-linked issuance for Sydney Airport

It is also the world’s first US Private Placement issuance.

High-yield non-financial Asian firms' default rate to rise 2.4% in 2020

China has been seeing an increased tolerance of defaults.

China's lenders to allow higher bad loans for COVID-19-hit firms

The People’s Bank of China will support qualified firms in order to resume production.

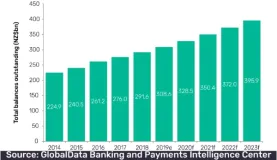

New Zealand retail lending to hit $265.6b in 2023

Total retail loan balance outstanding is set to reach the same amount.

Asian Development Bank worsens debt conditions: World Bank head

He hit the development banks in Asia, Africa, and Europe for lending too quickly to debt-heavy countries.

HSBC earmarks $3.9b in liquidity relief for businesses

It is easing borrowing terms to aid companies affected by the coronavirus outbreak.

MAS' monetary policy stance to remain unchanged despite nCov impact

S$NEER is still said to be in line with weaknesses in Singapore’s economy.

HPD Lendscape appoints former DBS senior VP as APAC regional representative

Kheng Leong Lee was also the former chapter director for Asia for Factors Chain International.

Deutsche Bank, Singapore hedge fund buy more of Indian lender's debt

The German bank almost doubled its debt hold to $56.8m (INR3b).

Why rebranding as an STO won't be enough to win back trust

Many large institutions and individuals are interested in the benefits that Security Token Offerings (STOs) could bring to Asia. These offerings give...

Australian borrowers hit by bushfires face risk of inadequate insurance coverage

Disruptions on local employment could drive arrears up.

Bank BRI partners with Investree to offer loans to entrepreneurs

It has earmarked more than $143m for digital lending via the platform.

Advertise

Advertise