Here's what delays the recovery of Indian banks

Troubled finance companies will hold banks back.

Stress in domestic corporate and nonbanking finance sectors will delay recovery of Indian banks, S&P Global Ratings reported. Analyst Geeta Chugh cited fragile financial markets, rising risk aversion, and weakness in some leveraged corporate sectors to affect asset quality and growth.

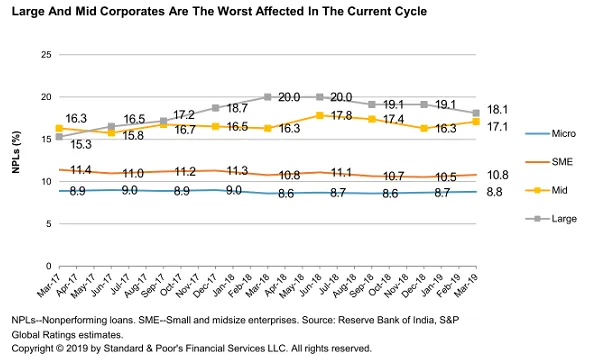

Loans made by 18.1% of large and 17.1% of midsize firms have turned nonperforming by March 2019. Delinquent loans made by small and midsize enterprises (SMEs) and micro loans are at 10.8% and 8.8% at the same time.

The amount of loans against property over 30 days past their due date also rose to 9% by Q4 2018, and household debt to GDP as of 31 March is at 15.6%.

Also read: The worst is almost over for worn out Indian banks

Smaller finance companies are also expected to increasingly resort to an “originate and sell” business model due to pressure on growth and profitability brought by tightened liquidity and increased funding costs.

Also read: Indian banks grapple with $10m liquidity crunch

Recovery will be on account of decline in provisioning costs, lower incremental slippages, recoveries from existing NPLs, and higher provisioning coverage. However, banks' return on average assets are expected to improve to 0.4% in 2019 from -0.1% in the previous year, but will remain much lower than the 1% in 2012.

Additionally, the Indian government has expressed plans to infuse capital of INR700b in 2019 for replenishing capital in public sector banks.

"However, unless these banks implement substantial reforms to improve risk management, the need for capital will recur," Chugh said. A separate report from Fitch Ratings notes that banks still need an additional $23b in 2019 just to meet regulatory norms even after the government embarked on a $32b recapitalisation programme is already underway.

Advertise

Advertise