Lending & Credit

Australian banks grapple with funding gap's historic low of 40% in Q1

Investor loan growth slowed to less than 1%.

Australian banks grapple with funding gap's historic low of 40% in Q1

Investor loan growth slowed to less than 1%.

Singapore banks' loan growth up 4.7% in May

ACU-driven overseas loans rose 7.5%.

Indonesian banks hold back loans for finance firms

The prominent default of a financing firm in 2018 hit bank confidence.

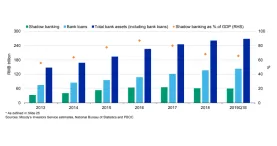

China's shadow banking assets fall to two-year low in Q1 even as crackdown eases

Core shadow banking activities have dropped to $420b in 2018.

Philippine banks conquer mounting bad loan risk

Corporates, which account for 76% of loans, have strong debt-servicing abilities.

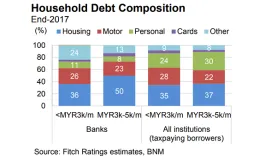

Malaysian banks bear weight of $234b household debt burden

Lower income borrowers account for 37% of household loans.

Millennials are snapping up Asia's short-term online loans

They are the top borrowers in India, Indonesia, Vietnam and the Philippines.

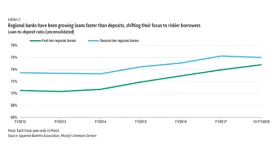

Japan's regional banks cash in on middle-risk loans

The share of real estate in total loans hit a record high 16%, thanks to regional lenders. Regional banks in Japan have been boosting their exposure...

Malaysian banks earnings slipped 0.5% in Q1

The sector’s pre-provision operating profit is at its lowest since Q1 2017.

Chinese banks' loan growth up 15% to $170.7b in May

It was lower compared to the $180b worth of new loans expected by analysts.

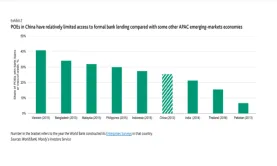

Which Asian banks have the freest credit line for POEs?

China is lagging behind with share of POE bank loans just at 26%.

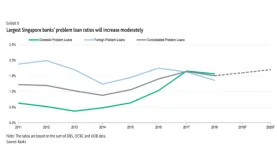

Singapore banks' bad loan ratio to hit 1.7% by 2020

Blame higher delinquencies from SMEs and non-financial firms.

Here's why Indian shadow banks are looking overseas

They have already clinched more than $2b worth of overseas bonds and loans in 2019. Bloomberg reports that shadow banks in India are looking outside...

Tougher mortgage rules await smaller Korean banks

The scheme is an attempt to help stabilise home prices. Korean second-tier banks will be subject to more stringent mortgage rules called Debt Service...

Mitsubishi UFJ Financial Group to cease coal financing

The banking group added forestry, palm oil and coal mining to its restricted transactions list.

OCBC's profit up 11% to $900m in Q1

Non-interest income surged 24% to $1.12b.

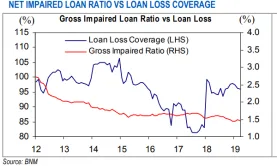

Chart of the Week: Malaysian banks' bad loan ratio down to 1.46% in March

Non-residential property loans were the only segment with deteriorating asset quality.

Advertise

Advertise