News

Japanese megabanks' annual profits fall as ultra-low rates take toll

Mizuho's profits plunged 83% to $877m.

Japanese megabanks' annual profits fall as ultra-low rates take toll

Mizuho's profits plunged 83% to $877m.

Which Singapore bank pays its staff the most?

This lender enjoys higher income from its institutional banking and treasury markets units.

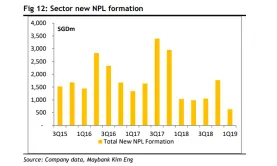

Singapore banks stand strong against bad loan wave in Q1

The formation of new bad loans in Q1 was the lowest in five years.

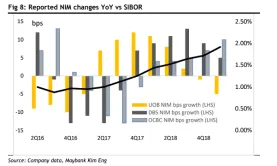

Singapore bank NIMs up 3bps in Q1

UOB was the only weak link as margins shrunk 5bps.

Japanese megabanks still reeling from lower net income

Sumitomo Mitsui projects a net income decrease of 4% to $6.39b in 2019. Bloomberg reported that Japanese megabanks are bracing for another tough year ahead of weakening net income amidst the weakening economy, rising trade tensions, and the sustained monetary easing from the central bank. Also read: Japanese bank woes to persist as ultra-low rates to last until 2020 Whilst both Mizuho and MUFG are expecting profit to increase this year, to $4.3b (JPY470b) and $8.22 (JPY900b),respectively, that’s only after they booked large writedowns that hurt results in the previous period. Meanwhile, Sumitomo Mitsui sees net income slipping about 4% to $6.39b (JPY700b). Net income projections from Sumitomo Mitsui Financial Group (SMFG), Mitsubishi UFJ Financial Group, and Mizuho Financial Group have all missed analysts estimates amidst rising bad loan costs and lesser gains from sales of stock holdings, which used to be its saving grace amidst rock-bottom interest rates. Also read: Japanese banks hit by lower net interest income as loan demand dwindles

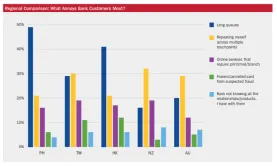

Chart of the Week: What annoys APAC bank users the most?

Frozen credit cards no longer spark as much annoyance.

Weekly Global News Wrap Up: HSBC, Citi, JPMorgan amongst those facing EU fines over forex rigging: report; UniCredit gears up for Commerzbank's bid

And Austrian Post is venturing into branch banking.

Philippine banks' profits surge 28% in Q1

Strong gains from trading and lending pushed up earnings.

Chinese banks stem lending in April as debt worries rise

Banks extended $150.16b in net new yuan loans.

Taiwan intensifies financial consultant oversight amidst theft reports

Fines for thefts committed by financial consultants since 2012 hit $2.78m.

Thailand banks' loan growth to slow to 4.5% by end-2019 as mortgages take hit

The LTV limit of 80% on home loans will cool demand for mortgages.

Thailand embraces facial recognition tech for e-KYC

FR is part of the broader shift towards the smart bank branch model.

Hong Kong grants four more virtual banking licenses with Ant Financial and Tencent entering fray

A unit backed by Chinese insurer Ping An also scored a license.

3 in 5 Hong Kongers prioritise data security over fast banking

Only 47% cited quick and easy banking as their top priority.

Ajay Mathur of DBS to share the secret to the bank's success

Beyond unique digital offerings, Ajay is also focusing his efforts on improving culture.

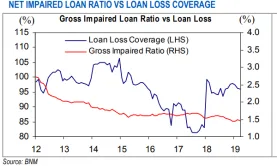

Chart of the Week: Malaysian banks' bad loan ratio down to 1.46% in March

Non-residential property loans were the only segment with deteriorating asset quality.

Weekly Global News Wrap Up: Barclays unveils new electronic trading platform; South African banks strengthen defense against armed robberies

And UniCredit Bank sells 17% stake in online broker FinecoBank.

Advertise

Advertise