News

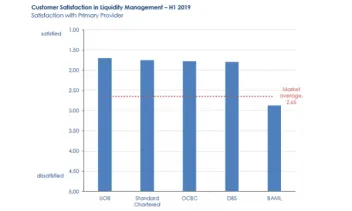

Which Singapore bank enjoys the highest corporate customer satisfaction?

A homegrown bank pulled ahead of global rivals like Standard Chartered.

Which Singapore bank enjoys the highest corporate customer satisfaction?

A homegrown bank pulled ahead of global rivals like Standard Chartered.

Vietnamese banks still suffer capital crunch despite dividend plan

State-owned banks can expect a mild capital boost of up to 30bps.

Weekly Global News Wrap Up: Credit Suisse to sell B2B investment fund platform; Citi kills some card perks

And German banks could face $695m over dividend tax concerns.

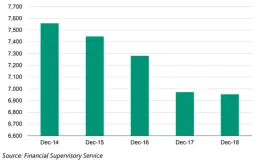

Chart of the Week: How many branches do Korean banks have left?

The number fell from as high as over 7,500 in 2014.

ICBC's Jimmy Chan to outline the threats and opportunities of open API

Competition and cooperation will shape the interaction between incumbents and TSPs.

Korea's virtual banks still struggle to find footing

Lenders grapple with low profitability and limited capital two years since they kicked off. After two years since their debut, Korean virtual lenders Kakao Bank and K Bank have managed to capture just 0.6% of the KRW-denominated loans market as of end 2018, according to a report by Moody’s with data from the Financial Supervisory Service (FSS). The lenders have been the most active in the unsecured personal loan market with plans to extend to retail loan segments like mortgages. “Korea’s two virtual banks have brought modest competition in some retail loan segments but no broad disruption in the two years they have been operating,” the report said. To jockey for market share, the ratings agency noted that K bank has a loan portfolio geared toward non-prime borrowers or individuals with credit rating less than four out of 10, pushing its delinquency rate above the regional banks. Meanwhile, Kakao Bank, with a higher portion of prime borrowers, has shown better asset quality compared to its commercial bank peers. Kakao Bank has focused its lending business on prime borrowers, and its proportion of loans with lending rates of less than 4% was at around 82% of total newly extended loans in May 2019. “Virtual banks have not yet shown competitive advantages in using proprietary data sources for underwriting. We expect asset quality of the virtual banks will reflect on the risk undertaken in terms of the proportion of high risk borrowers,” Moody’s said.

Philippine banks conquer mounting bad loan risk

Corporates, which account for 76% of loans, have strong debt-servicing abilities.

Will virtual banks threaten Singapore's big three?

Newcomers still have to create large funding and capital bases to contend with incumbents.

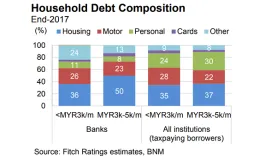

Malaysian banks bear weight of $234b household debt burden

Lower income borrowers account for 37% of household loans.

Thai bank profits to fall 1% in Q2

Thanachart Bank will get hit the hardest as earnings will fall 13%.

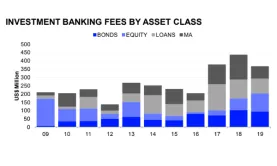

Singapore investment banking fees down 15.9% to $366.3m

Advisory fees for M&A deals shrank 49% to $76m.

Online bank hiring in Malaysia up 15% in March

It recovered from 9% decrease in the first two months of the year.

Korean regional banks look to SEA for growth

DGB Financial Group is aiming to open a bank branch in Vietnam. Regional lenders in Korea are betting on Southeast Asia for expansion amidst a saturated domestic market, reports The Korea Times. Daegu-headquartered DGB Financial Group revealed plans to open a bank branch in Vietnam after applying for license. A spokesman from the bank noted that DGB Daegu Bank acquired Cambodia's Cam Capital Specialised Bank in 2018 whilst DGB Capital launched DGB Laos Leasing Company in 2016. "We are looking for opportunities in Vietnam as Shinhan Bank did there. There are a lot of cultural similarities between Korea and Vietnam. This is one of the reasons we are seeking to launch services there," a DGB spokesman said. Also read: Foreign banks flock to Vietnam

Millennials are snapping up Asia's short-term online loans

They are the top borrowers in India, Indonesia, Vietnam and the Philippines.

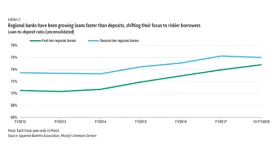

Japan's regional banks cash in on middle-risk loans

The share of real estate in total loans hit a record high 16%, thanks to regional lenders. Regional banks in Japan have been boosting their exposure to firms with higher credit risks and to the real estate sector as they battle against declines in domestic loan yields, Moody’s said in a report. As a result, regional banks have been leading systemwide loan growth, boosting loans faster than deposits. “Some regional banks' strategy is to boost what they classify as ‘middle-risk’ loans to small and medium-sized enterprises (SMEs) that rank on the lower end of creditworthiness,” the report said.

Can Australian banks meet heavier capital requirements?

The regulator is proposing an aggregate-level risk-weight floor based on internal ratings-based approach.

Malaysian banks lead Southeast Asia in board diversity

Women make up over a third of boards compared to only 9% in the Philippines.

Advertise

Advertise