News

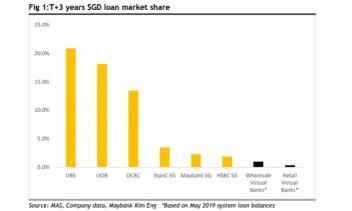

Virtual banks may only account for less than 1% of Singapore loan market by 2022

Retail upstarts may account for 0.3% market share and wholesale challengers will take 0.9% of the market.

Virtual banks may only account for less than 1% of Singapore loan market by 2022

Retail upstarts may account for 0.3% market share and wholesale challengers will take 0.9% of the market.

Korea resumes applications for third internet-only bank

Rejected applicants Toss Bank and Kiwoom Securities are welcome to re-apply.

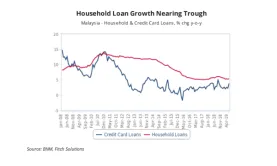

Chart of the Week: Can households buoy Malaysia banks' loan growth?

The sector makes up 5.7.8% of the total loans.

Weekly Global News Wrap Up: Societe Generale reportedly eyeing to sell UK private banking arm; Wells Fargo slapped with $6.61m fine in Ireland

And bank licensing boom hits South Africa.

How GoBear makes financial comparison easy for the everyday consumer

Its platform matches users with financial products like insurance, credit cards, and trade finance.

Banks cash in on Vietnam's micro-consumer loan segment

The sector’s interest rates could exceed 50% per year.

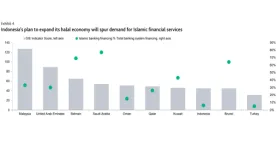

Islamic financing in Indonesia lags Malaysia and Brunei

Government initiatives could boost halal economy and bolster demand for Islamic financial services.

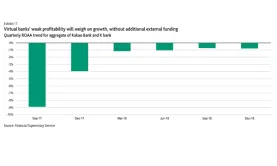

Chart of the Week: Korean virtual banks still struggling to crack the profitability code

ROAA is still relatively low at -0.9% in December 2018.

Weekly Global News Wrap Up: Deutsche Bank reportedly eyeing to cut 20,000 jobs: EU banks short of $153b to meet capital requirements by 2027

and Austrian banks survive government's staged cyberattacks.

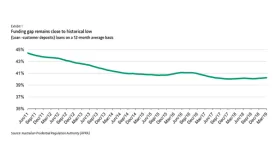

Australian banks grapple with funding gap's historic low of 40% in Q1

Investor loan growth slowed to less than 1%.

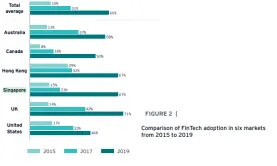

Singapore's fintech adoption rate almost tripled to 67% in two years: study

It is ahead of the APAC average adoption rate of 64%.

Malaysia and Indonesia go head-to-head on Islamic banking digitisation

Malaysian Islamic banks could lean on their parent groups cashing in to boost digital drive.

Singapore banks' loan growth up 4.7% in May

ACU-driven overseas loans rose 7.5%.

Japanese banks foray into big data through personal info brokering

Sumitomo Mitsui Trustbank received approval to operate an information bank. Japanese banks are entering a new era as they go into personal info brokering, The Asahi Shimbun reports. The government-backed Japan Federation of IT Associations has given the green light for Sumitomo Mitsui Trustbank and Felica Pocket Marketing, a subsidiary of retailer Aeon Co., to operate a data brokerage service that will allow them to establish an information bank that will buy and sell customers' personal data. Under the service, the company will receive data from customers such as their name, purchase history and health-related information, in trust. Upon customer consent, the bank will provide data to companies that are eyeing to develop new products. Similar to the bank's practice of paying interest on a deposit, customers who shared their information will be compensated with cash, coupons or bank services.

Singapore joins digital banking race with five licenses up for grabs

The five licenses are split into two full digital and three wholesale.

Indonesian banks hold back loans for finance firms

The prominent default of a financing firm in 2018 hit bank confidence.

Hong Kong banks to scrap minimum balance fees

HSBC, BEA, StanChart, and Hang Seng did the move in anticipation of stiffer competition from virtual lenders. Amidst the rise of virtual banks, three major Hong Kong banks revealed that they will waive minimum balance fees for their customers in a move to further boost financial inclusion. Starting August 1, HSBC, Bank of East Asia (BEA) and Hang Seng Bank will remove minimum balance fees for certain accounts. HSBC was the first to announce that it will enable free basic banking services for their customers with passbooks, statement accounts, personal and advance integrated accounts, as well as those with super ease accounts. The move will also kill monthly or annual service fees and miscellaneous charges such as counter transaction fees for some personal savings account. Currently, bank users of HSBC’s personal integrated account need to pay a monthly fee of $7.68 (HK$60) once the average total balance reaches $640 (HK$5,000) over a period of three months. Meanwhile, those with advanced integrated accounts pay $15.36 (HK$120) when a three-month average balance is less than $25,601 (HK$200,000).

Advertise

Advertise