News

Weekly Global News Wrap Up: Deutsche Bank to build $56b bad bank; Big Nordic banks cut compliance jobs

And banks in Nigeria are tapping on a growing youth demographic.

Weekly Global News Wrap Up: Deutsche Bank to build $56b bad bank; Big Nordic banks cut compliance jobs

And banks in Nigeria are tapping on a growing youth demographic.

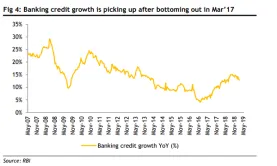

Chart of the Week: Indian banks' credit growth hit 13% in May

Home and retail sectors drove lending gains.

Singapore slaps three-year prohibition orders against former UBS banker

Paris Michele was discovered to have falsified company emails and forged documents.

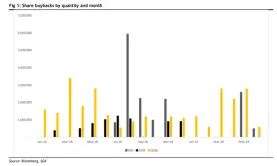

Singapore banks step up buyback spree to rescue share price

Most of the buybacks by DBS were done in May, when the share price fell 14%. Singapore banks’ share buybacks have picked up steam in 2019. A Maybank Kim Eng report noted that DBS and OCBC have bought back more shares YTD and much earlier than they did last year. Maybank KE analyst Thilan Wickramasinghe expounded that DBS has bought back 25% YTD of the volume it bought in 2018. “Importantly, this was mostly done in May 2019, when its share price fell 14%. Historically, DBS was most active buying back shares in Q3/Q4,” the analyst said. Meanwhile, OCBC has bought back 60% of the volume it bought in 2018 and much earlier, the analyst added, noting that the DBS and OCBC buybacks in Q2 2019 are equivalent to 55% and 53%, respectively, of their treasury shares balances. Also read: Singapore's big banks are on a buying spree as share buybacks hit $116.5m “We believe this is an indicator of emerging value. Our scenario analysis suggests that non-performing loans (NPLs) would need to rise 35-80% from current levels to bump credit charges up to levels seen during the O&M crisis and GFC,” the analyst explained. The buyback spree happening in Singapore can also be observed in other markets such as the United States, Natixis chief economist for the Asia and Pacific Alicia Garcia-Herrero and INSEAD finance professor Theo Vermaelen said in a previous interview.

Malaysian banks earnings slipped 0.5% in Q1

The sector’s pre-provision operating profit is at its lowest since Q1 2017.

Chinese banks' loan growth up 15% to $170.7b in May

It was lower compared to the $180b worth of new loans expected by analysts.

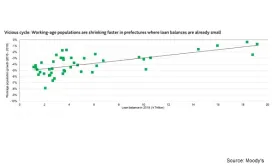

Chart of the Week: Here's where Japanese banks' shrinking loan balances are hitting harder

More than half of lenders based in Chugoku, Koshinetsu, Shikoku and Tohoku earned less revenue.

Global Weekly News Wrap Up: Wells Fargo to shell out $386m to customers; JP Morgan kills mobile banking app a year after launch

And banks in the EU have paid $24.2b to central bank since 2014. From Reuters:

China launches risk hedging tool to ease jitters after Baoshang Bank takeover

It is offered to investors in the $289m worth of six-month certificates of deposit.

New Hong Kong virtual banking licenses spur demand for data jobs

The hottest roles will include data scientists, UI engineers, and full stack developers.

Korean banks step up game to lure baby boomers

KEB Hana will create a taskforce to focus on premium pension products.

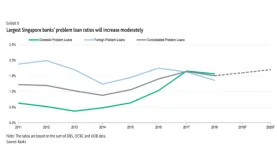

Singapore banks' bad loan ratio to hit 1.7% by 2020

Blame higher delinquencies from SMEs and non-financial firms.

Taiwan embraces facial recognition in online banking

Taishin Bank will utilise the technology for clients with iPhone X by Q3.

Korea banks on big data infrastructure

It will create a financial data exchange for financial players in the country.

Japanese lenders team up with global banks for blockchain-based digital coin

It will be used to speed up overseas money transfers.

Open banking could uplift Australian banks

The big four banks will be required to make data available for transactions by February 2020.

Here's why Indian shadow banks are looking overseas

They have already clinched more than $2b worth of overseas bonds and loans in 2019. Bloomberg reports that shadow banks in India are looking outside the country in search for earnings amidst lenders that have been hesitating in extending funds.

Advertise

Advertise