Lending & Credit

Australian banks' profitability to suffer from tighter mortgage lending standards

The share of new loans with high loan-to-value ratio fell to 22.3% in December.

Australian banks' profitability to suffer from tighter mortgage lending standards

The share of new loans with high loan-to-value ratio fell to 22.3% in December.

How will the new regulatory measures impact Aussie banks?

Regulators issued new limits on interest-only mortgages.

Chinese banks exposed to considerable latent asset risks: Moody's

Almost a fifth of corporate debt is supported by cash flows that do not fully cover interest expenses.

Why are Hong Kong banks cautious towards lending to mainland state-owned entities?

27% of SOEs are loss-making.

Chinese banks cut bad loan ratios for 2016

China Construction Bank and Agbank reported lower NPL ratios.

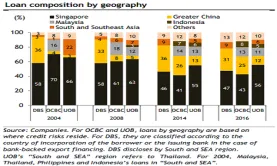

Chart of the Week: Where are the lending opportunities for Singapore banks?

Loan growth increased the most in overseas markets.

Why big Chinese banks might be 'secretly happy' with deleveraging

Higher borrowing costs seem to be a boon for them.

How will Hong Kong banks' capital levels be affected by the recent sale of their insurance business?

The additional capital would balance the banks' higher risk appetite for China-related activities.

Malaysian banks' external liabilities hit US$39.6b in 2016

It accounted for 17.3% of the banks' balance sheets.

Singapore banks' profits could fall by up to 8% in FY17

The banks' oil & gas woes are still not over.

Bank loan applications in Malaysia drop for the seventh consecutive month

Loan approvals also contracted 5.1% in January 2017.

Here's a rundown of Singapore banks' O&G exposures in 4Q16

UOB has the lowest O&G exposure.

Hong Kong banks' risks from property exposure still "manageable": Fitch

Mortgage loans of Hong Kong banks only totalled US$144b in 2016.

Which Malaysian bank will benefit the most from slowing household loan growth?

Total outstanding household loans grew at a slower rate of 5% in 2016.

DBS to be hardest hit if Ezra Group goes into liquidation

DBS has the largest exposure to Ezra at US$452m.

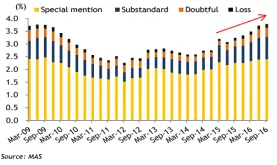

Chart of the Week: Singapore banks' classified exposure level at its worst since 2009

The banks' credit quality is still worsening.

Thai banks' loan growth projected to hit 6% in 2017

Growth will be driven by consumer loans.

Advertise

Advertise