Lending & Credit

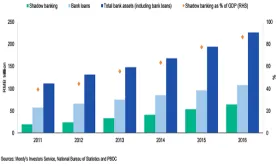

Why Chinese shadow banking activity stopped growing in 1H17

Nominal GDP also grew faster than shadow banking assets.

Why Chinese shadow banking activity stopped growing in 1H17

Nominal GDP also grew faster than shadow banking assets.

Thai banks' NPLs likely rose to 3.75% in 3Q17

The sector’s earnings may have risen by only 1%.

Japanese megabanks' overseas asset risks escalate

More than 70% of the banks' overseas loans were to non-Japanese clients.

China's outstanding WMP balance down by around 10% so far this year

The shadow banking crackdown is finally showing some results.

Four reasons why low interest rates are a bane for big Thai banks

It could hurt the banks' investment income.

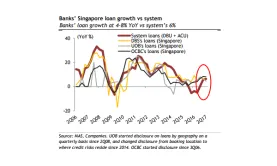

Chart of the Week: Check out Singapore banks' loan growth vs system loan growth

System loan growth was 6%.

Are fixed rate mortgages Singapore banks' response to FFR hike delays?

UOB, HSBC, and DBS recently launched 3-year fixed rate home loan packages.

Thailand, Indonesia report higher ratios of restructured loans compared to ASEAN peers

Such loans grew quickly in the first three months of 2017.

Why Singapore banks will still be laden with O&G woes

Every 10bps increase in credit cost estimate will cause a 7% cut in net profits.

Shadow banking risks focused on China's regional lenders

Rust belt banks use shadow banking to conceal their bad loan status.

Here's how China's shadow banking sector evolved over the years

The regulators and financial institutions seemingly have played a “Whack-A-Mole” game, says BBVA.

What will drive Singapore banks' sharp loan growth recovery?

The 7.6% growth in July was a significant improvement from the low of -2.7% in May 2016.

Two reasons why rising NPLs will continue to haunt Thai banks in 2H17

The weak SME economy is partly to blame.

Traditional lending in China sees a 'renaissance' as shadow banking slows down

Net corporate bond issuance has been increasing.

Chart of the Week: Shadow banking in China more than doubled since 2012

Shadow banking assets reached US$9.5t in 2016, but growth is finally slowing down.

Is China making progress in reining in shadow bank growth?

The enhanced regulation is finally showing some results.

Chinese banks in Australia boost corporate lending by 23% as the big four pull back

They also increased their direct property lending by 50%.

Advertise

Advertise