Lending & Credit

Growing property exposure pose risks to Philippine banks

CAGR of real estate loans stand at 22% from 2012-2017 versus overall loan growth at 17%.

Growing property exposure pose risks to Philippine banks

CAGR of real estate loans stand at 22% from 2012-2017 versus overall loan growth at 17%.

Can Indian banks weather the last wave of bad loan resolution?

Profitability is set to suffer but cleaner balance sheets will produce benefits in the long-run.

Hong Kong banks lift time-deposit rates amidst expected rate hikes

Standard Chartered and ICBC raised time-deposit rates to more than 2%.

Housing downturn will not shake Australian banks

Mortgage portfolios will remain intact amidst adequate capital buffers.

China makes headway in denting distressed debt

Foreign investors are rushing into the country to purchase its NPLs.

UOB forms joint venture with credit scorer Pintec

The joint venture will have a capital of up to $10m.

Korea's bad loans shrink as new NPLs stood at $1.59b in Q1

This marks the lowest level since the global financial crisis struck.

Can the VAMC single-handedly halt Vietnam's bad loan woes?

It has already bought $9.4b in NPLs from various banks.

Malaysian banks shrug off debt to buffer against market shocks

A decline in high-risk consumer loans prompted weaker household debt growth in 2017.

Can Vietnam halt the exponential growth of its bad debt?

VAMC was able to resolve 27.9% of NPLs it purchased in 2017.

China banks are the sixth largest creditor group globally

Its cross border financial assets was valued at US$2t in Q3.

Hong Kong and China amongst the most vulnerable to a banking crisis

Hong Kong has one of the worst credit-to-GDP gaps globally.

Deustche Bank appoints Aleksandar Pfajfer as managing director, head of lending & deposits in APAC

It also names Tony Tan as director, head of strategic lending in Asia and head of lending Southeast Asia and South Asia.

Why private sector leverage levels are high in many APAC banking systems

Leverage levels are particularly high in China, Hong Kong, Singapore, Korea and Vietnam.

Why the slowdown in China's shadow banking is not as good as it seems

The borrowing is just moving around.

Singapore banks to suffer from more energy-related NPLs in Q4

Oil and gas service exposures make up 2-3% of the banks' loans.

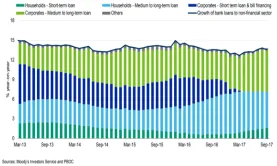

Chart of the Week: China's consumer loans on the rise

The steady increase caught the regulators' attention.

Advertise

Advertise