Lending & Credit

China issues RMB3 billion bond in London

This is its first-ever international RMB bond issued outside China.

China issues RMB3 billion bond in London

This is its first-ever international RMB bond issued outside China.

Asian banks brace for more bad loans as commodity pressures mount

Singaporean and South Korean lenders are among the most exposed.

Vietnamese banks under threat from $1.25b debt restructuring plan

Loss-absorption buffers will take a hit.

Chinese lenders roll out first bad loan securitization since 2008

China Merchants and Bank of China are first in line.

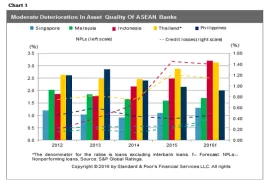

ASEAN banks' asset quality to suffer as regional slowdown bites

Will there be a sharp spike in delinquencies?

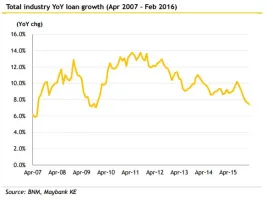

Malaysia's industry loan growth disappoints as household loans slip to just 7%

A mere 6.5% loan growth is forecast for 2016. According to Maybank Kim Eng, industry loan growth continues to slow, with the moderation in HH loan...

Undesirable lending practices uncovered at some local banks: Monetary Authority of Singapore

Credit underwriting standards need to be improve.

These charts summarise Singapore banks' worrisome O&G exposures

The banks will likely suffer from deteriorating asset quality.

Bank Mandiri needs higher NPL buffer, warns analysts

NPLs rose despite strong 12% growth.

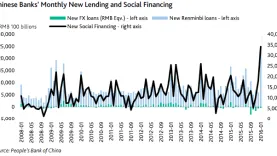

New RMB loans hit a record RMB2.51 trillion in January 2016

The pace of credit growth exceeds economic growth, analysts warn.

20% of UOB’s exposure to the oil & gas sector vulnerable to potential impairment

That is if oil prices remain depressed.

How badly can RHB’s oil and gas exposure hurt its profitability?

It would slip into the red if 40% of its O&G book turned non-performing.

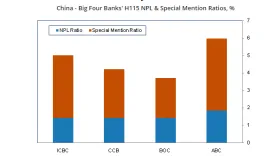

Chinese banks' NPL figures 'highly understated'

NPL ratios could jump to as much as 6%.

Australian banks' credit costs feared to increase from current low levels

Blame it on the unwinding of the global commodities cycle.

Core shadow banking activity in China remains subdued

But other forms of shadow banking are rapidly expanding.

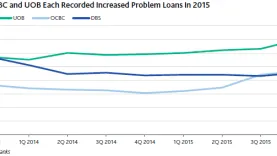

Singapore banks face more defaults as oil and gas malaise spreads

DBS and OCBC are most exposed.

Malaysian banks' base rates unlikely to rise

OCBC Malaysia and UOB Malaysia are merely normalizing their rates.

Advertise

Advertise