Retail Banking

Chinese and Indian banks to drive global Additional Tier 1 issuance in 2017

Indian banks issued around USD2.8bn so far in 2016.

Chinese and Indian banks to drive global Additional Tier 1 issuance in 2017

Indian banks issued around USD2.8bn so far in 2016.

Here's why Thai banks are solid enough to weather shocks

They have a pretty high capital base.

3 key risks that Hong Kong banks must face

Weakness of the Chinese yuan is one.

Everything you need to know about CIMB Thai's new branch inside a 7-Eleven store

Find out if the bank's tiniest branch will also operate 24/7.

How resilient are banks in emerging Asia against negative shocks?

Emerging Asian banks outperform other regions in Moody's stress tests.

Indian banks' loan growth to fall to 6%, the slowest since 1962

Banks are hit hard by the demonetisation aftermath.

Philippine banks' net earnings growth could narrow to 4% in 2017

Blame it on trading gains that are expected to plunge 33%.

Asian banks' funding and liquidity remains a credit strength: Moody's

Banks in Asia are mostly deposit-funded.

Vietnam banks' NPL ratio reaches 9%

The 2.4% NPL ratio reported at end-2015 was understated.

Bangkok Bank sued by Fox for not paying bank guarantees worth US$71m

But the bank insists it does not have to pay.

Thai banks' asset quality continues to weaken

Risks are prevalent in the SME and unsecured retail loans segments.

Chinese banks struggling with heightened risks

No thanks to the shadow banking system having assets equal to 82% of GDP.

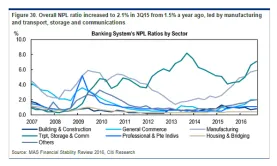

Chart of the Week: Check out the Singapore banks' NPL ratios by sector

Overall NPL ratio increased to 2.1%, led by manufacturing, and transport, storage and communications.

Singapore banks to be affected by modestly higher risk-weight charges in 2017

But capitalisation remains stable.

There's nothing to worry about Philippine banks' liquidity in 2017: Fitch

The low aggregate loan-to-deposit ratio of 71% is proof.

RBI denies rumors of cancelling Axis Bank's licence

Axis Bank is the country's third-biggest private sector lender by assets.

ASEAN banks brace for weak loan demand and asset quality pressure in 2017

But they are generally well-placed to cope with the difficult credit environment.

Advertise

Advertise