Retail Banking

China banks in 2017: No rebound in sight, rising risks for smaller banks

China bank risk is on the rise. The unweaving focus by both markets and regulators – ranging from individual bank to financial system stability as a...

China banks in 2017: No rebound in sight, rising risks for smaller banks

China bank risk is on the rise. The unweaving focus by both markets and regulators – ranging from individual bank to financial system stability as a...

Bank Rakyat Indonesia reports 2.1% NPL for 2016

Analysts think the bank can maintain this low NPL in 2017.

Singapore banks' loan growth improved slightly but still "lethargic": analyst

System loans increased in December for the first time in 2016.

Indian banks' asset quality indicators close to their weakest levels

Recovery will be slow over the next few years.

Transaction banking veteran Expedito Garcia Jr. to share first-hand experiences on digitalisation in the Philippines

He heads the customer engagement group at Philippine Bank of Communications.

One of Manila's tech and e-commerce experts to speak at the Retail Banking Forum's Manila leg

Find out more about Security Bank's e-commerce head Mark Bantigue.

Hong Kong banks still well capitalised despite poor profit outlook

Total capital ratio came in at 19.4% in September 2016.

3 implications on banks' financials when MFRS 9 takes effect in 2018

One is that there will be a one-off provision charge to retained earnings.

Australian banks' dividend payout 'increasingly unsustainable'

Analysts recommend cutting dividends to preserve cash.

Are Thai banks resilient enough to withstand negative sector trends?

Capital and loan-loss buffers are adequate, says Fitch.

Krungsri's 11% loan growth in FY16 the highest in the industry

Will robust growth continue in 2017?

Japanese banking sector assets as a share of GDP now at a record 211%

Total assets were up 5.5% in November 2016.

Philippine banks' loan-to-deposit ratio among the lowest in Asia

This reduces refinancing risk in the banking system.

Korean banks to suffer from domestic political instability

Political instability may delay legislation that introduces a bail-in feature.

Gross NPA ratio of Indian banks rose to a 14-year high of 9.1% in September 2016

Poor banking sector profitability looms over the next months.

Weekly Global News Wrap Up: HSBC to cut 380 jobs in the UK; EU mulls testing banks' defenses against cyberattacks; Will banks move to Amsterdam post-Brexit?

And banks are urged to offer assistance to customers with mental health problems.

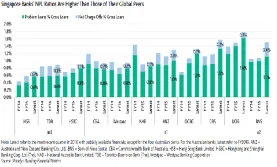

Chart of the Week: Singapore banks' NPL ratios higher than their global peers'

OCBC has the highest proportion of overseas NPLs.

Advertise

Advertise