News

Chinese banks' 2016 results prove profitability pressures persist

Smaller banks reported weaker liquidity positions.

Chinese banks' 2016 results prove profitability pressures persist

Smaller banks reported weaker liquidity positions.

Taiwanese banks' profitability and asset quality expected to recover this year

Loan demand will also pick up to mid-single-digit growth.

Here's why the 2017 Asian Banking and Finance Retail Banking Forum Singapore is worth attending

The event will be held on April 26 at the Pan Pacific Singapore.

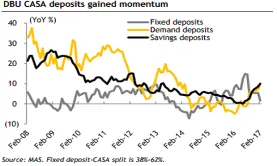

Chart of the Week: Singapore banks' domestic banking unit CASA deposits gain momentum

Banks in Singapore continue to offer attractive rates.

Weekly Global News Wrap Up: Goldman Sachs, Bank of America report increased profits for Q1; Wells Fargo tests Facebook chatbot

And find out how regulators risk putting banks on a fast track out of London.

Indian banks urged to raise provisions as bad loans mount

Lenders are asked to make provisions at rates higher than the regulatory minimum.

China's off-balance sheet lending surged $109b in March

Bloomberg says China’s shadow banking is back in full swing.

Asian private banks' assets under management reach record high in 2016

AUM increased 6.1% to $1.55t in 2016.

Here are the 4 latest trends in China's banking sector

Banks are confident on 2017 asset quality.

India's struggling banks could be forced to merge with rivals

That is if their capital levels fall below the new standard issued by the central bank.

Australian banks' profitability to suffer from tighter mortgage lending standards

The share of new loans with high loan-to-value ratio fell to 22.3% in December.

Indian banks expected to post strong earnings growth for 4Q17

But there is one bank that might report a sharp decline in profits.

Chinese banks to continue to struggle with declining profitability this year

Blame it on the tight market liquidity.

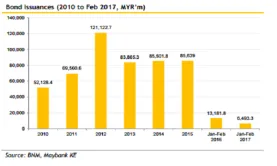

Chart of the Week: Malaysian banks' bond issuances still lagging

Issuances only totalled US$1.1b in February.

Could setting up specialised banks in India bridge the country's infrastructure gap?

The RBI is looking for ways to finance $1.5t in projects.

Sharia-compliant investment accounts at Malaysian banks hit US$16.7b in February

Growth will remain strong over the next 3-5 years. An emerging trend among Malaysian banks is the strong growth of Sharia-compliant investment accounts, report Moody's. This began in July 2015 following the implementation of the Islamic Financial Services Act 2013, and has since taken off. Sharia-compliant investment accounts (“investment accounts”) are defined in the Act as accounts under which money is paid and accepted for investment in accordance with Sharia principles and on terms that state there is no express or implied obligation to repay the money in full. By February 2017, investment accounts had grown to MYR74.2 billion (US$16.7b), or 13% of total Islamic banking system liabilities. Here's more from Moody's:We expect growth in investment accounts in Malaysia to remain strong over the next 3-5 years as a result of the active promotion by the regulator and banks. Malaysian banks have strong incentives to promote investment account growth because it provides capital benefits and an additional source of funding to grow their assets. Concerns over untested loss-sharing mechanisms in investment accounts. Banks could suffer deterioration in their credit profiles if the loss-sharing mechanism in these investment account products turn out to be less robust than currently assumed. At the present development stage of Malaysia’s investment accounts, a key issue is whether, and to what extent, the loss-sharing mechanism between banks and investors will be honored in case of actual losses. Similar products in other regions have led banks to bear the entirety of the asset risks. Our concern is underpinned by our observation that Islamic banks in other Islamic jurisdictions, notably some Gulf Cooperation Council (GCC) countries, in practice do not exercise the contractual loss-absorbing nature of investment accounts, and as a result, bear much, or all, of asset risk on behalf of investment account holders. This is perhaps because of customer expectations and out of fear of reputational damage. Safeguards are present to protect banks. A mitigating feature for Malaysia is that regulators have put in safeguards to protect banks. In Malaysia, the regulatory framework

(1) identifies and differentiates the risk profile of investment accounts from traditional principal-guaranteed deposits; (2) emphasizes the disclosure of the risk-sharing mechanism in investment account products to investors; and (3) obliges the investment account holders to share risks with the banks.

What makes China's city commercial banks more vulnerable to disruption?

The banks are increasingly exposed to spillover and contagion risks. The rapid growth of China's city commercial banks over the past decade is increasing their systemic importance and contributing to higher systemic risks, says Fitch Ratings. Here's more from Fitch Ratings:City commercial banks' asset structures have been shifting towards non-loan financial products to enhance yield, which coupled with their thinning liquidity and weak capital buffers, render city commercial banks more vulnerable to financial system disruption compared with larger banks. The banks are increasingly exposed to spillover and contagion risks, while access to timely liquidity support is also less certain. Their rising systemic importance implies any excessive risk building-up in this sector could lead to higher overall systemic risk.Direct and indirect local government ownership of city commercial banks and high geographic and sector concentration expose these banks to strong implicit and explicit influence. Supporting local economy funding needs may run counter to sound corporate governance and prudent risk management, and weigh on the banks' standalone credit profiles.Fitch believes local governments have a strong propensity to support city commercial banks, but their ability to do so varies and may be restricted by limited intrinsic financial capacity and China's fiscal system. In the absence of a systemic crisis, Fitch believes the central government would be willing to provide timely and sufficient ordinary support to an individual bank to limit contagion risk. However, the agency's assessment of support addresses the likelihood of extraordinary support during times of systemic stress; under such a scenario, the home city's relative importance to the state and the bank's importance to the local economy will be key factors in determining sovereign support propensity.

Advertise

Advertise