News

Why a bad bank is not the answer to India's debt dilemma

A government adviser says India already has five reasonably-sized asset reconstruction companies.

Why a bad bank is not the answer to India's debt dilemma

A government adviser says India already has five reasonably-sized asset reconstruction companies.

Global transaction banks developing blockchain proof of concept

ANZ and DBS are amongst the banks working with SWIFT.

Total fintech funding in Asia drops to US$492m in Q1

Only US$406m in venture capital funding was raised in Asia.

Chinese regulators to increase scrutiny of the shadow banking sector

These new measures are likely to be negative for corporate bonds.

Malaysian banks' system deposits up 0.8% to US$3.2b in March

CASA expanded at a faster rate of 8.3%.

Singapore banks' loan growth to be 'relatively subdued'

That is despite a slight recovery in February.

Here's what to expect from Malaysian banks' asset quality over the next 12-18 months

New NPL formation is seen to stabilise.

Weekly Global News Wrap Up: European banks to lose more market share to US banks; HSBC to advise on world's biggest IPO

And Deutsche Bank is fined $156m for forex violations.

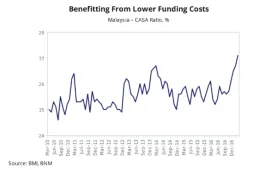

Chart of the Week: Malaysian banks to benefit from lower funding costs

Thanks to the system's CASA ratio rising to a multi-year high of 27.1% in February.

Smaller banks in China post weaker capital and liquidity positions

This is due to their faster asset growth rate.Moody's Investors Service says that the 2016 results of the 11 listed Chinese banks rated by Moody's continued to testify to profitability pressures from China's slowing economic growth, despite the absence of any significant deterioration in reported asset performance.

Thai banks strong enough to weather consumer lending slowdown: analyst

Thanks to the banks' strong capital positions.

Banks withdraw from $1.7t worth of Chinese investments

As banks pull out, Chinese bonds and equities retreat, says Bloomberg.

Philippine banks to see positive growth over the medium term

Thanks to strong economic growth in the country.

Taiwanese banks' profitability to recover modestly in 2017

Loan demand will also pick up to mid-single-digit growth.

Indonesian banks to finally see a slowing pace of NPL growth

Credit uptake will likely increase in the coming quarters.

Chinese banks to remain under pressure even after growing their profits in 2016

Net interest margins will continue to narrow and asset impairments will increase.

Singapore banks' ROEs to stay depressed at 8-9%

NIMs are expected to remain muted with only a 1-2bp pickup.

Advertise

Advertise