News

Asian private banking assets hit $2.01t in 2017

The world’s wealthy are increasingly turning to Asia.

Asian private banking assets hit $2.01t in 2017

The world’s wealthy are increasingly turning to Asia.

Singapore refuses to compel banks to divulge open banking data

The central bank is taking a more organic approach, enabling banks to share data on their own.

Bad debt burden delays Basel III adoption in Indian banks

The leeway would give banks much-needed time to raise more capital.

Can the VAMC single-handedly halt Vietnam's bad loan woes?

It has already bought $9.4b in NPLs from various banks.

APAC banks plan to use automated collections systems by 2019

Seven in 10 banks intend to utilise AI to streamline bill payments.

Singapore amongst the most open to digital banking

Almost half believe non-banks provide better assistance than traditional banks.

Why you should not miss the 2018 Retail Banking Forum in Kuala Lumpur

The event will be held on April 25 at the Shangri-La Hotel, Kuala Lumpur.

Hong Kong to link central bank system with Japan for faster cross-border transactions

These will streamline transactions of Japanese government bonds and Hong Kong dollars.

Indonesian banks shoulder growing bad debt burden

NPL volumes hit $9.8b in 2016 representing almost a double increase in bad loan ratio.

How can Philippine banks fully shed off bad loans?

NPLs hit $3.2b as of September 2017 with NPL ratio at a stable 1.9%.

Weekly Global News Wrap Up: BofA halts lending to firearm makers; US watchdog may slap record fine vs Wells Fargo

And here’s the real cost of Brexit to the UK financial services industry.

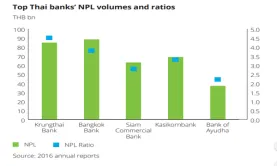

Chart of the week: Check out the bad loan ratio of Thai banks in 2017

Gross NPL volume rose 20% to $11.6b in Q2.

Japanese banks join cashless revolution in digital shift

This follows a regulatory change facilitating third party access to accounts and data.

Construction firms' on-time payments boost Singapore banks

NPL ratios tied to the construction sector were 0.2%-0.8% at year-end 2017.

Higher loans buoy profits of Chinese state banks in Q4

ICBC, CCB, and ABC achieved the strongest expansion in net interest income.

Negative interest rates batter small Japanese banks hard

Bad loan ratio stood at 1.8% in September 2017 versus 0.7% for massive banking players.

Malaysian banks shrug off debt to buffer against market shocks

A decline in high-risk consumer loans prompted weaker household debt growth in 2017.

Advertise

Advertise