News

Singapore and Vietnam tie up for fintech cooperation

Additionally, the two countries also revised a partnership on banking supervision.

Singapore and Vietnam tie up for fintech cooperation

Additionally, the two countries also revised a partnership on banking supervision.

Are ecosystems the key to boost bank returns?

Networks of ecosystem partners and access to more data lower costs of customer acquisition.

Nearly 2 in 5 Hong Kongers open to sharing banking data with third parties

Almost 40% believe that open banking can provide them with better customer service.

Weekly Global News Wrap Up: UBS wealth management underperforms in Q1; Embattled Wells Fargo faces shareholders and protestors

And Nigeria’s central bank has injected $210m into the interbank foreign exchange market. From Reuters: Swiss bank UBS disappointed investors on Monday with first-quarter results that revealed strong earnings at its investment bank, while its flagship wealth management business missed forecasts. UBS’s wealth business, which was merged into one global division this year, netted 19 billion francs in new money but fell short of expectations with pre-tax operating income of 1.13 billion francs. Wealth management’s disappointing performance, plus its higher costs and UBS’s cautious outlook, put pressure on the bank’s shares which fell as much as 4 percent.

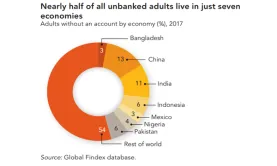

Chart of the Week: Check out which countries have the largest unbanked populations

Two Asian countries snagged the top two spots.

Bank account ownership in India surges to 80%

The Jan Dhan Scheme has brought an additional 310 million people into the banking system.

Philippine banks go digital with launch of electronic fund transfer service

InstaPay enables transactions of up to PHP50,000 per day.

China's RRR cut cushions lenders against impact of shadow banking crackdown

The cut aims to encourage banks to move from WMPs to deposit funding.

India's banking woes dampen economic outlook

The banking sector is saddled with $210b in problem loans. Bloomberg reports that India’s chronic bad debt problem has spiraled beyond the control of the formal banking sector to the extent that it has dampened economic forecasts for the country. "The problems in India’s banking system are self-inflicted mostly because of lack of due diligence," said N.R. Bhanumurthy, a Delhi-based economist at the National Institute of Public Finance & Policy. "Of course this will affect growth."

Hong Kong banks scrap fixed-rate mortgages as interbank lending rates surge

HSBC and BOC have stopped offering the popular loans whilst ICBC will stop on May 1.

Indonesia makes headway in curbing its unbanked population

Almost half of adults now have a bank account, up from a fifth in 2011.

Will the looming property slowdown set back Hong Kong banks?

Loan growth is expected to slow in 2018.

APAC banks grapple with growing property risks: Fitch

Rising property loans and household indebtedness may pose problems for banks’ balance sheets soon. Higher levels of property exposure are raising the associated risks for Asia Pacific’s banking sector with Australian and New Zealand banks exhibiting the highest residential property risk, according to credit rating agency Fitch. Risks will remain high in the two markets as household debt grows due to rising home prices, driving future growth prospects for property loans.

APAC banks to launch cross-border real-time payments via SWIFT gpi

DBS, ANZ, Kasikornbank, and ICBC are amongst the participants.

New reporting standards to aid China's shadow banking crackdown

IFRS 9 will support Beijing’s bid to curb credit growth and balance sheet consolidation.

MAS tightening to bolster Singapore banks' performance

Banks are set to benefit from rising loans which grew 10%, as well as higher SGD and USD interest rates.

Which APAC banks need to brace for IFRS 9 impact?

Find out which banks may face difficulty amidst a lack of long-run historical data.

Advertise

Advertise