News

Philippine central bank chief signals possible interest rate cut in Q1

The bank lowered rates by 75 basis points last year.

Philippine central bank chief signals possible interest rate cut in Q1

The bank lowered rates by 75 basis points last year.

Malaysian banks' net profit to grow 4.8% in 2020: report

But NIMs are expected to taper off a further 3bps over the period.

Singapore monetary board receives 21 digital bank licence applications

Fourteen applied for digital wholesale banks whilst seven went for digital full banks.

AI is top fintech trend of 2019: study

The value of AI in the fintech market is expected to rise four times by end-2024.

Razer Fintech-led consortium bids for digital full bank licence

It will take up a 60% majority stake in the proposed Razer Youth Bank.

Credit costs to weigh on Singapore banks in 2020

Combined with shrinking NIMs, this will burden bank earnings.

Grab and Singtel team up for digital bank license bid

Grab and Singtel will hold a 60% and 40% stake in the consortium, respectively.

V3 Group and EZ-Link-led consortium join Singapore's digital banking race

BEYOND consortium has launched a bid for a digital full bank license with a focus on SMEs.

It's the most wonderful time of the year!

We're taking the time off!

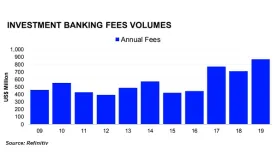

Singapore's investment banking fees hit record-breaking $868.1m in 2019

DBS Group clinched 11.8% or $138.79m of the total fee pool.

Japan's central bank begins lending ETFs to investors

This is part of its move to enhance market liquidity for the instrument.

Bank of Japan retains policy rate

It maintained its short-term interest rate at -0.1% and the 10-year government yields at 0%.

Nearly 1 in 3 Singaporean millennials prefer cashback cards

Cashback cards are preferred due to their instant benefits.

Thailand's central bank maintains policy rate at 1.25%

It will likely remain on hold in 2020, although a 25bp cut remains probable.

Chinese banks' asset performance deteriorates

Asset and loan growth slipped to 8.9% and 12.8% YoY in September, respectively.

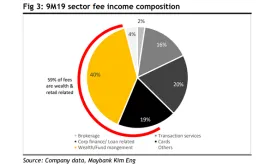

Chart of the Week: Wealth and retail drive 60% of Singapore banks' fee income

DBS and OCBC’s private wealth AUM grew 15% CAGR in the past 6 years.

Weekly Global News Wrap: Saudi's biggest bank scraps $200b lender; Goldman Sachs to support green projects

And the PNC-Venmo fight highlights issue over who owns customers’ banking data.

Advertise

Advertise