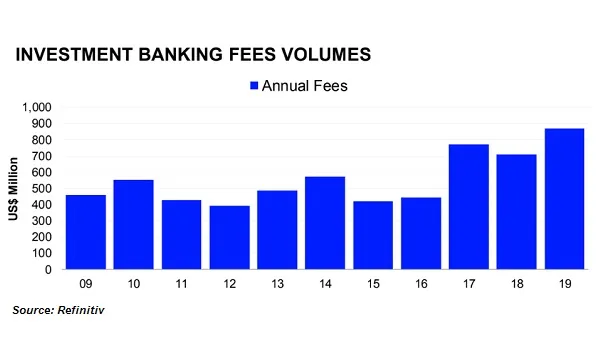

Singapore's investment banking fees hit record-breaking $868.1m in 2019

DBS Group clinched 11.8% or $138.79m of the total fee pool.

Singapore investment banking activities generated more than$868.1m (S$1.17b ) in fees in 2019, up 22.1% YoY from last year and the strongest annual period since records began in 2000, according to a report by Refinitiv.

Advisory fees for completed mergers and acquisitions (M&A) totalled a record-high$261.4m(S$354.29m) this year, up 14.6% YoY compared from 2018.

ECM underwriting fees skyrocketed 90.3% YoY from a year ago to a nine-year high of $208.6m (S$282.73m) whilst fees from DCM underwriting edged up 2.7% YoY to $238.14m (US$175.m).

Syndicated lending fees also expanded 10.2% YoY to totaling $222.4m (S$301.43m).

Of the three major banks, DBS Group Holdings earned the most in investment banking fees for the year and topped the fee league table with a total of $102.4m (S$138.79m) to clinch 11.8% share of the total fee pool in Singapore.

By industry, financials and real estate tied for the first spot, each making up approximately 27% of the market share. Government and agencies followed, taking up 16% of the share; whilst industrials, as well as media and entertainment made up 11% and 9%, respectively.

Advertise

Advertise