Hong Kong

Asian markets tumble on China financial crisis

Stock markets weaken after PBOC insists there is ample cash in the banking system.

Asian markets tumble on China financial crisis

Stock markets weaken after PBOC insists there is ample cash in the banking system.

BNP Paribas Wealth Management unveiled 7th next generation programme

It had a record numer of attendees.

Renminbi trading eclipses HK$ in Hong Kong for first time

Result shows the renminbi’s rising importance in international trade.

Things you must know about JP Morgan's newly-launched Collateral Central

Find out what the 'virtual global longbox' does.

Hong Kong residents investing more in RMB products

RMB assets to rise to 32% of their portfolios.

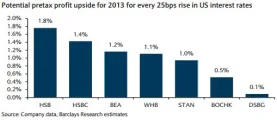

Check out how rising interest rates will affect Hong Kong banks' profits

Hang Seng and HSBC will benefit the most.

Standard Chartered RMB globalisation index reaches record high of 925

London’s market share surpassed Singapore’s.

These are the 5 key priorities for Asia Pacific treasurers over the next 2 years

Cash flow forecasting is the primary challenge.

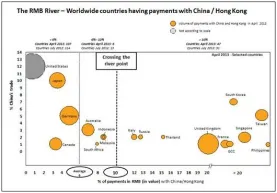

Hong Kong's dominant role to remain in RMB trading

Given that RMB is fungible offshore, the emergence of new offshore centres simply expands the existing regime instead of creating competing systems. As such, we do not expect the recent development to have much impact on Hong Kong; especially when the market is already relatively mature after eight years of development. Being an important entrepot of the mainland, Hong Kong is currently handling more than 80% of all RMB payments and receiving over 50% of all letters of credit sent by banks in China (Chart 1).

Standard Chartered completes its pilot CNH HIBOR Fixing IRS

It's structured using the new 3-month CNH HIBOR Fixing.

Citi trades first ever CNH/USD cross–currency swap transaction

Transaction will be effective in early July.

More countries use RMB for more than 10% of their payments with China and Hong Kong

There are now 47 countries worldwide.

Doha Bank to open in Hong Kong

Expects to have an office in the next few months.

HSBC developing tailor-made financial services

Targets are Chinese companies planning overseas ventures in Europe.

Galaxy Securities takes in US$1.07 billion from HK IPO

It’s one of Hong Kong’s largest deals since late 2012.

BOC Hong Kong backs SME financing

Launches privileged guarantee fee subsidy.

Standard Chartered appoints Philip Tulk as conglomerates, hotels and gaming analyst

In a statement, Standard Chartered announced the appointment of Philip Tulk as Conglomerates, Hotels and Gaming Analyst. Philip is based in Hong Kong and reports jointly to John Chan, Head of HK/China Property, Conglomerates & Gaming Research and Erwin Sanft, Head of China/HK Equity Research. In this role, Philip will be responsible for covering the greater China gaming and hotels sector. He will also work closely with John Chan to provide a strategic view of the Hong Kong conglomerates sector. Philip joins the Bank from Royal Bank of Scotland, where he was head of the Asian conglomerates and gaming research. He brings more than 15 years of sell-side experience to Standard Chartered, having previously held roles at Lehman Brothers, DBS, and HSBC. Welcoming Philip to the Bank, Erwin Sanft said, “Philip’s addition to the team demonstrates our commitment to delivering a compelling research value proposition to our clients. I believe Philip’s wealth of experience will be invaluable in bringing our capabilities and service offerings to a new level. I look forward to his contribution as we continue to deliver on our Hong Kong and China franchise ambitions.”

Advertise

Advertise