China

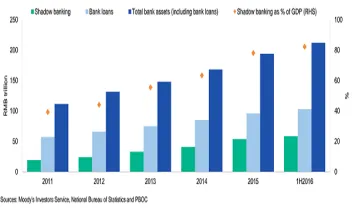

Chart of the Week: China's shadow banking size doubled in the last five years

Borrowers relying on such financing could be at risk of a credit crunch.

Chart of the Week: China's shadow banking size doubled in the last five years

Borrowers relying on such financing could be at risk of a credit crunch.

Chinese banks still struggling with compliance

Bloomberg says the Agricultural Bank of China's recent $215m fine is proof.

Bank of East Asia (China) appoints Cartier Lam Chi-man as executive director & chief executive

He succeeds Mr. Kwan Tat-cheong

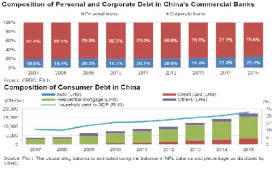

Chart of the Week: Consumer debt financed by Chinese banks amount to USD2.6t at end-2015

Consumer debts comprise 24.4% of Chinese banks' loans.

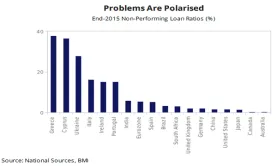

Chart of the Week: Check out which countries are suffering from the highest NPL ratios

Distressed eurozone countries are the worst hit.

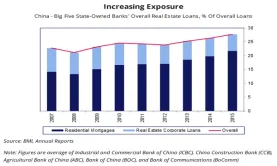

Chart of the Week: Chinese banks' real estate loan exposure rose to 27.7% in 2015

Residential mortgages accounted for 21.6% of total loans.

China's evolving bank restructuring: From loan-to-equity to loan-to-convertible bond swaps

It has been two years since Chinese banks have seen their luck turn sour with raising NPLs and decreasing profits. Preoccupied by other issues – including the collapse of the stock market and a huge loss of reserves after a mini-devaluation – the Chinese government only turned to the banks' situation early this year. Most of the actions taken have been piecemeal and uncoordinated.

Deloitte names Patrick Tsang new China CEO

He receives the baton from Lawrence Chia.

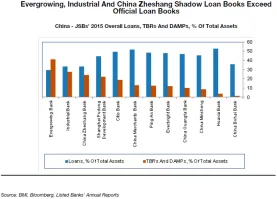

Chart of the Week: These 3 Chinese banks' shadow loan books exceed their official ones

Asset quality is feared to deteriorate further.

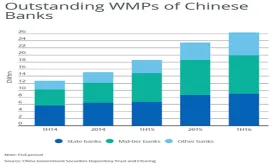

Chart of the Week: Growth of China's wealth management products at its slowest in two years

It reached USD3.9tr or 17% of system deposits in 1H16.

Rising risk for Chinese banks: Asset growth buoyed by wholesale funds, not deposits

Banks are now more sensitive to potential counterparty failure.

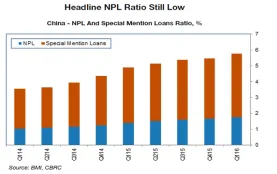

Chart of the Week: China's NPL ratio still highly understated at 1.8%

True NPL ratio could be as high as 30%.

Recapitalisations and bailouts begin for Chinese banks

It's time to clean up the banking sector.

Proposed stricter regulations to address key wealth management risks in China

Risks include banks' losses from their own investments.

Chinese banks' asset quality risks rise as leverage grows rapidly

There are two scenarios to help frame the potential scale of risk and policy solutions.

Chinese banks warned of heightened risks as shadow banking sector grows

Find out which types of banks are most vulnerable.

Slower markets don't necessarily spell doom & gloom for jobs

Slower economic conditions around the region are certainly impacting our banks and financial services institutions, but that doesn’t mean hiring & recruitment has come to a complete halt. Organisations still need talent to keep operations running and lead them into new growth areas. This requires talent in different shapes and sizes than previously. Shifting sands just means a shift in focus is required to different functions, roles, or skills to meet current market conditions.

Advertise

Advertise