China

China banks in 2017: No rebound in sight, rising risks for smaller banks

China bank risk is on the rise. The unweaving focus by both markets and regulators – ranging from individual bank to financial system stability as a whole – reflects a sense of urgency that actions are needed to contain the risk. This is no easy job. And at least in the government’s mind, it requires not only a trade-off between short-run profitability and long-term system risk of commercial banks, but also balancing the interest between different players in the financial industry, for example, insurers and asset management corporations (AMCs).

China banks in 2017: No rebound in sight, rising risks for smaller banks

China bank risk is on the rise. The unweaving focus by both markets and regulators – ranging from individual bank to financial system stability as a whole – reflects a sense of urgency that actions are needed to contain the risk. This is no easy job. And at least in the government’s mind, it requires not only a trade-off between short-run profitability and long-term system risk of commercial banks, but also balancing the interest between different players in the financial industry, for example, insurers and asset management corporations (AMCs).

Chinese banks' deteriorating asset quality mitigated by debt to equity swaps

8% special-mention loans is already offloaded.

Chinese banks to find it costly to issue wealth management products this year

Regulators are tightening rules on WMPs.

Chinese banks' good capital buffers mask 3 key weaknesses

2017 might prove more difficult in terms of solvency.

OCBC's loan growth in Chongqing tripled in November 2016

Thanks to the launch of the Chongqing Connectivity Initiative.

Chinese banks to be more cautious in issuing wealth management products in 2017

Banks have already issued RMB 26.4t as of 2Q16.

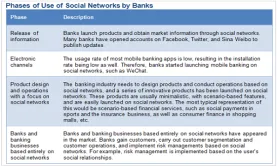

Check out how Chinese banks use social media

They normally use social networks in 4 phases.

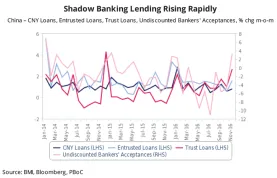

Chart of the Week: Check out how China's shadow banking lending is rising rapidly

Overall stock of total social financing grew 13.3% in November.

Will Chinese banks continue to shift towards investment banking?

Investment would expand from 27% to 30% of total assets in 2016.

Shadow credit in China surges to US$69b in November

It was only US$7.9b in October.

How will the slowing buildup in corporate leverage affect Asia Pacific banks?

Deleveraging efforts increases risks to banks' asset quality.

HSBC launches US$290m lending scheme in China

It's to finance startups in Guangdong.

Chinese banks struggling with heightened risks

No thanks to the shadow banking system having assets equal to 82% of GDP.

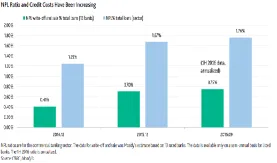

Chart of the Week: Chinese banks' NPL ratio and credit costs edge up as at end-September 2016

NPL ratio reached 1.76%.

3 factors that will pressure Chinese banks' profits in 2017

Rising credit costs is one.

3 'powerful' trends emerging amongst Chinese banks

Loan-for-bond swaps added around US$868b to banks' investment books.

Chinese banks warned of asset quality shocks as market for wealth management products expands

Around US$2.9t worth of WMPs are off-balance sheet at end-1H16.

Advertise

Advertise