China

Mortgage lending buoys China Construction Bank's home advantage

It accounted for 31.4% of CCB’s total loans and 81.7% of personal loans.

Mortgage lending buoys China Construction Bank's home advantage

It accounted for 31.4% of CCB’s total loans and 81.7% of personal loans.

China relaxes informal deposit rate ceiling for commercial banks

This may help Beijing curb growing shadow banking activity.

What does ING Bank's Aart Jan den Hartog leverage on to push the bank's Greater China growth?

He reveals how the bank specialises in China-Europe network connectivity.

HSBC deploys team to service Greater Bay Area's tech talent

The bank is keen on serving customers in Guangdong and Hong Kong in particular.

Higher loans buoy profits of Chinese state banks in Q4

ICBC, CCB, and ABC achieved the strongest expansion in net interest income.

China's big banks turn to short-term financing to offset deposit woes

Issuance of negotiable certificates of deposit ballooned to $68b in Q1.

Global asset managers in China: Opportunities arising from structural reform

This is now an inflection point for foreign asset managers as China vows to allow foreign players to take controlling stakes and operate domestically in the private securities fund management (PFM) and even mutual fund management markets.

China Construction Bank's profit rose 9% to $6.5b in Q4

Net interest margin expanded 2.36% as credit card loans and consumption loans performed strongly.

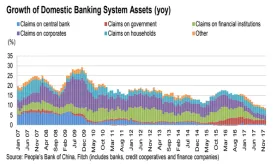

Chart of the Week: Here's a historical look at China's domestic banking assets

Claims on the corporate sector represent 36% of loans.

China's big banks profits surge 4.9% to $30.5b in 2017

ICBC, CCB, and Agricultural Bank of China all posted improved profitability.

China banks expand household lending and wealth management business

Bank lending to households represent half of GDP and 82% of disposable income in 2017.

China banks poised for profit as combined net income to rise 8% in 2018

A recovering domestic economy is boosting loan demand.

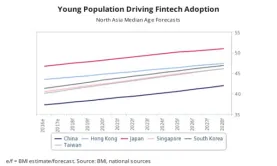

Chart of the Week: Here's how the younger generation in China pushes fintech growth

They are likely to help the continued penetration and popularity of e-payment systems.

China bank's medium-term loans up to $155.06b in February

The country's deleveraging campaign boosted return of funding demand to on-balance sheets.

China banks are the sixth largest creditor group globally

Its cross border financial assets was valued at US$2t in Q3.

China's “matryoshka” approach for debt-to-equity swaps could be good for banks, but bad for investors

Chinese banks seem to have made meaningful progress in the resolution of problem loans. The aggregate amount of the announced debt-to-equity (D/E) swaps has reached 1 RMB trillion, to 19.5% of problem loans by the end of 2017. However, words are louder than actions as only 15.7% of the total announced D/E swaps have been executed. Banks clearly need to move faster in their cleanup and Chinese regulators are not only aware but also increasingly supportive. To this end, the big five banks have established their own asset management companies (AMCs) to help carry out debt-to- equity swaps. The way in which banks and their asset management companies will operate for the loan cleanup was clarified in a new guideline jointly published by regulators last January.

China eases banks' bad-loan coverage ratio to 120%

The lower non-performing loan rules will allow banks to extend more credit.

Advertise

Advertise