China

JPMorgan Chase appoints Mark Leung as CEO in China

This follows the bank's plans to further grow its onshore business capabilities in China.

JPMorgan Chase appoints Mark Leung as CEO in China

This follows the bank's plans to further grow its onshore business capabilities in China.

China Construction Bank unveils Shanghai branch fully managed by robots

AI, facial, and voice recognition tech power the self-service branch in Huangpu district.

Chinese banks' money supply received boost from RRR cut

Net interest margins are poised to widen amidst more loans to deploy.

Chart of the Week: Check out the growth of AUM held by China's asset management industry

Assets under management exceeded $15.69t.

China regulator slaps three banks with $29m fine for industry malpractice

The banks violated proper lending practices amongst other multiple transgressions.

China banks' time deposits up but loans slow in Q1

Accounts with specified maturity dates rose 11.8% for ICBC, 7.5% for CCB, and 6.2% for ABC.

Citi China rolls out voice biometrics authentication

This can slash verification time from 45 seconds to 15 seconds.

China banks' assets plunge to single digits in 2017 as loans take over

Intense shadow banking crackdown has reinvigorated on-balance-sheet activity. China’s banking system assets plunged from 16.5% in 2016 to 8.7% in 2017 to represent the first drop to single-digit growth in more than a decade, according to a report from Moody’s Investors Service, reflecting the ongoing transition of banks to on-balance-sheet activities like loans. Loan growth clocked in at a steady 12.1% which makes last year the first year since 2013 that loan growth has outpaced asset growth. The welcome development comes as China intensifies its shadow banking crackdown as regulators step up oversight and incorporating related rules in their Macro Prudential Assessment (MPA).

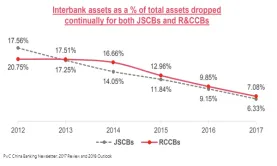

Chart of the Week: Here's how China's shadow banking crackdown hit assets in 2017

Financial investments and interbank activities were the most battered areas.

New regulations to overhaul China's outdated wealth management model

The principal-preserved model may not survive under new rules.

China Construction Bank profits up 5.4% to $11.67b in Q1

The lender was able to keep its bad loan ratio flat at 1.49%.

China's shadow banking crackdown slows home market

A tightening lending environment may cause property sales to plummet.

China's RRR cut cushions lenders against impact of shadow banking crackdown

The cut aims to encourage banks to move from WMPs to deposit funding.

Citi inks deal with BOC and CMB to explore co-financing Belt & Road projects

The bank has business coverage across 60 of 70 B&R markets.

New reporting standards to aid China's shadow banking crackdown

IFRS 9 will support Beijing’s bid to curb credit growth and balance sheet consolidation.

Chinese banks may ramp up lending amidst $63.62b additional liquidity

Reserve requirement ratio for big commercial banks will be lowered from 17% to 16%.

China makes headway in denting distressed debt

Foreign investors are rushing into the country to purchase its NPLs.

Advertise

Advertise