APAC banks grapple with rising property risks

In China, propety exposure has grown to 15% of sector assets.

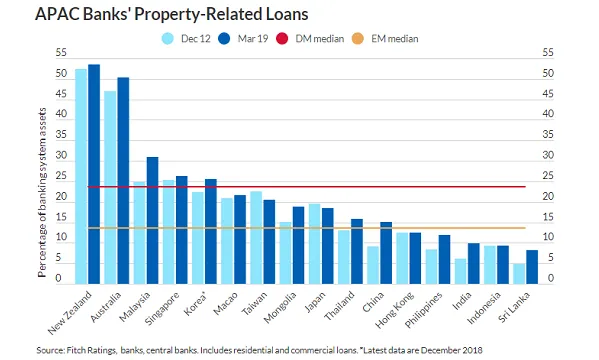

Banks in Asia Pacific grapple with increasing property related risks with lenders in Australia and New Zealand having the greatest exposure to property market stress and banks in Sri Lanka, Mongolia and Vietnam having the least protection from loss-absorption buffers, according to Fitch Ratings.

Developed economies in Asia generally have higher banking-sector exposure to property and indebted households than emerging countries. The exception are Australia and New Zealand which have household debt-to-GDP ratios of 129% and 94% by the end of 2018. On the other hand, the property exposures of banks in emerging countries tend to be lower although risks are building up as government increasingly turns to the property sector to support economic growth.

"Rapid credit growth often masks asset-quality issues, and rising property exposure makes banks more vulnerable to a property downturn, particularly where loss-absorption buffers are lowest (Mongolia, Sri Lanka and Vietnam). Property related risks in India and Sri Lanka may be understated due to indirect exposures and limited data transparency. Vietnamese banks appear susceptible in light of rapid consumer loan growth coupled with large legacy bad-debt issues and thin capital buffers," Fitch Ratings said.

Also read: Growing property exposure pose risks to Philippine banks

In China, the sector's property exposure has increased to 15% of banking assets as of March 2019.

Rising household debt poses a risk to banks as the debt-servicing capacity of borrowers is rendered more vulnerable to economic factors. A high reliance on property to collateralise loans also exposes banks to a property downturn. Fitch warns that an accommodative monetary and economic policies are likely to aggravate leverage levels although regulators are likely to step up oversight to support financial stability.

"We believe that regulatory oversight and macro-prudential policies should contain the direct effect of a residential property downturn on banks, especially in developed markets where loss-absorption buffers tend to be higher. However, accommodative monetary and economic policies could aggravate leverage," the credit rating agency said.

Advertise

Advertise