Retail Banking

Why Thai banks are well placed to absorb loan losses

They have enough reserves even if 25% of thier restructured loans become NPLs.

Why Thai banks are well placed to absorb loan losses

They have enough reserves even if 25% of thier restructured loans become NPLs.

Vietnamese banks' asset quality expected to improve with new collateral repossession rules

Banks can now speedily repossess collateral for a nonperforming loan.

How will Indonesian banks' NPLs be impacted by the end of OJK's lenient restructuring?

NPLs will remain close to 3% by the end of 2017.

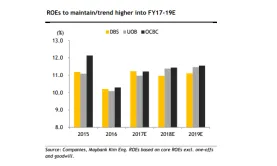

Chart of the Week: Singapore banks' ROEs to trend higher into FY18-19E

Maybank Kim Eng outlines three reasons behind this forecast.

OCBC's net profit to grow 3% in the next two years

This will be on the back of higher loan growth.

RHB, AmBank call off merger plans

The banks were not able to reach an agreement on mutually acceptable terms for the merger.

Indian banks remain 'moderately capitalised'

Overall Capital Adequacy Ratio stood at 13.74% as of March 2017.

Why the property sector remains a key risk for Hong Kong banks

The prevalence of high-LTV second mortgages increases default risks for homebuyers.

DBS invests $20m to train employees to become digital bankers

The bank will launch a programme that comprises AI-powered learning.

Why analysts see UOB's selective lending strategy attractive

The bank remains disciplined in its pricing.

Malaysian banks' total system deposits growth slows to 3.5%

Government deposits contracted for the 12th consecutive month.

More unfavourable regulations to impact Thai banks

Policies may even target leasing companies as well.

Australian banks' compliance issues get exposed

Thanks to the recent money laundering crackdown.

Standard Chartered names Pedro Cardoso as global head, digital commerce

Standard Chartered announced that Pedro Cardoso has joined its Retail Banking team taking on the role of Global Head, Digital Commerce on 2 August...

Bank Rakyat Indonesia's profit up 10.5% to US$1b in 1H17

Thanks to micro, consumer, and SME lending.

Maybank loan-to-deposit ratio stands at 94.7% as of March 2017

The bank sought to clarify a Bloomberg report that said its LDR is 101%.

State Bank of India mired in asset quality woes

Sharp NIM compression, weak loan growth, and merger pains are to blame.

Advertise

Advertise