Retail Banking

DBS profit surges 20% to $1.37b in Q2

Strong consumer and non-trade corporate lending offset weak trading income.

DBS profit surges 20% to $1.37b in Q2

Strong consumer and non-trade corporate lending offset weak trading income.

Krung Thai Bank and Kasikornbank hit by data leak

However, no financial damage has been found.

Hong Kong trails behind Singapore in ease of bank account opening for non-locals

Startups, SMEs, and foreign nationals lament the inefficiency.

Philippine banking assets up 12.2% to $292.95b in May

A surge in deposits drove banking gains.

Hong Kong bank loans up 0.9% in June

IPO loans worth $1.95b drove lending gains.

Weekly Global News Wrap Up: Fintech firms can soon win US bank charters; Credit Suisse charged with rigging forex rates

And here's the key behind Standard Chartered's profit surge.

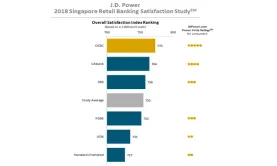

Chart of the Week: Which Singapore bank enjoys the highest customer satisfaction?

Lenders with attractive interest rates stand the best chance.

Can Thai banks keep their bad loan woes at bay?

Lending to SME operators will keep NPL formation levels elevated.

UOB rolls out fully automated car loan application process

This cuts processing time from three days to 15 minutes.

Singapore bank lending up 5.9% to $673b in June

Corporate lending drove the monthly loan growth.

Mizuho taps on Japan's wealthy elderly to boost dismal lending

The bank aims to achieve a $2.7b asset balance in the next five years.

Will mortgage rate hikes boost Australian banks' bad loans?

Small banks have been lifting out-of-cycle mortgage rates in recent months.

Bank Central Asia profit up 8% to $791.09m in H1

Earnings were boosted by higher interest income and lower interest expense.

Chinese banking assets up 7.1% to $37t in June

The country is home to the world’s largest banks.

YES Bank Q1 loan growth doubles by 53% while state counterparts flounder

Retail and business lending ballooned by 56%.

HDFC loan growth beat industry average at 22% in Q1

Personal, credit card, two-wheeler and business lending performed strongly.

China moves to cut capital requirements to ease bank lending

Parameters for macroprudential assessments may be lowered.

Advertise

Advertise