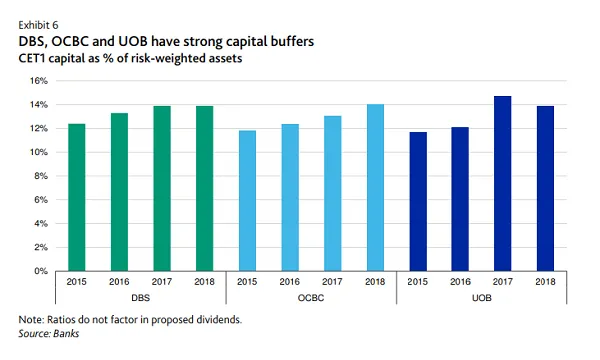

Singapore's big three banks' CET1 ratios hit 14% in 2018

Of its peers, only UOB saw declining CET1 ratios amidst faster loan growth.

This chart from Moody’s Investor Service shows that the Common Equity Tier 1 ratios (CET1) of Singapore’s three banks' remained strong at around 14% by end-2018.

CET1 ratios at DBS and OCBC rose at the end of 2018 from three months earlier, mainly as a result of growth in retained earnings, whilst UOB reported a decline due to faster loan growth.

Also read: Singapore banks' NIMs rose to 1.8% in 2018

According to Moody’s, CET1 ratios at DBS and UOB will decline by up to 50 basis points in 2019 due to dividend payouts but will remain within their target ranges of 13.0%-13.5%, giving the banks ample capital buffers against growing risks.

“The decline for OCBC will be much smaller because the bank maintains a scrip dividend scheme,” Moody’s said.

DBS maintained its final dividend at 60 cents/share whilst OCBC and UOB increased dividends by 21.1% and 7.7% to 23 cents/share and 70 cent/share, data from UOB Kay Hian show. For 2018, payout ratios of DBS, OCBC and UOB stood at 56%, 41% and 51% respectively with an attractive dividend yield of 4.8%, 4.4% and 4.7%.

Advertise

Advertise