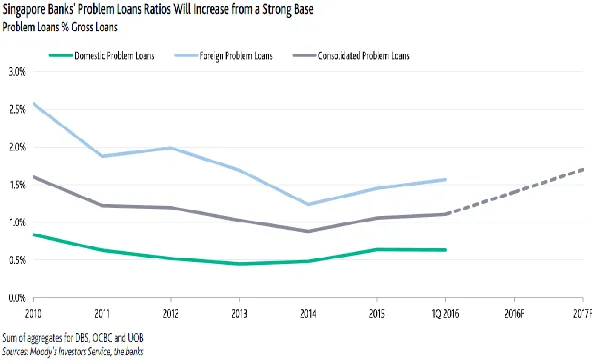

Singapore banks' problem loans ratio to increase to 1.8% by end-2017

Expect weaker quality loans in Malaysia, Thailand, Indonesia and China.

According to Moody's Investors Service, the consolidated problem loans ratio for the three large Singapore banks will increase to 1.8% by end-2017 from 1.1% at end-March 2016. Problem loan ratios were already up 20 basis points in 2015, mostly led by the weaker quality of energy-related loans.

The banks will likely maintain their strong problem loan coverage levels in excess of 100%. This buffer is in addition to the good collateralization of existing problem loans. For example, their coverage ratio for unsecured problem loans is at around 300%-400%.

"Macroeconomic conditions have weakened in the key overseas markets in which Singapore banks operate, resulting in increased pressure on their overseas loan books. Foreign loans made up around 50% of gross loans at end-2015 for the three large banks. We expect that Singapore banks will continue to exhibit weaker quality loans in Malaysia, Thailand, Indonesia and China. The banks’ problem loan ratios have historically registered higher levels outside of Singapore, and mainly in emerging markets that tend to show higher asset-quality risks when compared to Singapore," said Moody's.

Advertise

Advertise