Singapore bank NIMs set to widen to 1.98% in 2020

However, this is still lower than the 2008 average.

Singapore banks' net interest margin, a common measure of profitability, is poised to continue widening to settle at 1.98% in 2020 although at a markedly slower pace compared to over ten years ago, according to UOB Kay Hian.

"The three banks had an average NIM of 2.19% in FY08, whilst we forecast FY20 average NIM of 1.98%. When the FFR rose from 1% to >5% between mid-2003 and mid-2007, the three Singapore banks generally recorded wider NIMs – in FY08, the three banks had an average NIM of 2.19%, which was very much higher than our FY20F of around 1.98%," analyst Leng Seng Choon said in a report.

Also read: Singapore bank earnings up 25% in 9MFY18

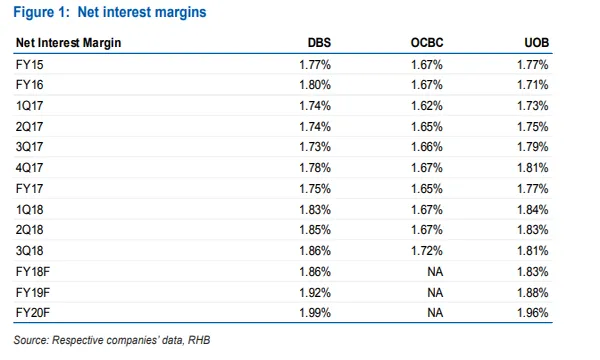

The NIM of DBS is expected to clock it at around 1.86% in 2018, 1.92% in 2019 and 1.99% in 2020 on the back of rising trend of the US Federal Funds Rate.

UOBs NIM is similarly forecasted to inch slowly from 1.83% in 2018 to 1.88% in 2019 given that funding costs are expected to rise further as the full 3-month impact from the fixed deposits raised in August and September finally kicks in. From then on, NIMs are poised to widen further to 1.96% in 2020 amidst higher lending yields.

Also read: Singapore bank loan growth to slow to 3% in 2019

There was no data forecasts for OCBC although the report noted that its NIMs also rose from 1.67% in Q1 to 1.72% in Q2.

"Combined, the quarterly net interest income for the three banks has gradually grown in recent years and has been consistently above S$4.0 billion ($2.92b) for each quarter since the end of 2014. This has coincided with gradual increases of local interest rates as represented by the 1-month Swap Offer Rate (“SOR”) and 3-month Singapore Interbank Offered Rate (“SIBOR“)," the Singapore Exchange said in a previous report.

Advertise

Advertise