Singapore bank NIMs hit 1.84% in H1

Margins widened in tandem with rising interest rates.

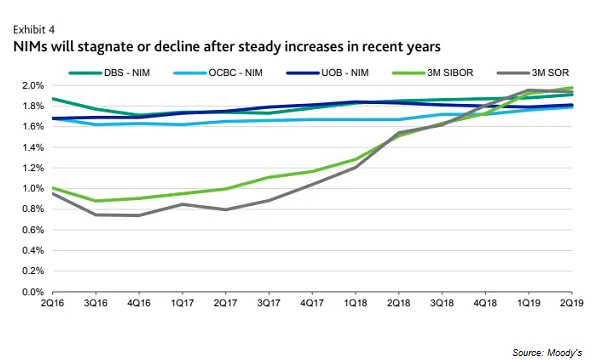

The net interest margins (NIM) of Singapore's big three banks rose to an average of 1.84% in the first half of the year from 1.8% in the previous year, 1.75% in 2017 and 1.68% in 2016 as headline figures consistently tracked the upward movement in interest rates, according to Moody's.

Also read: Singapore bank NIMs to widen to 1.98% in 2020

"Interest rates in Singapore typically move in tandem with US interest rates. Hence, if the US Fed continues to lower rates following the latest 25 basis point cut in July, interest rates in Singapore will also decline," Moody's said in a report.

However, NIM, a common measure of profitability, is unlikely to further improve over the coming months with expectations of either stagnation or decline as central banks cut rates globally and credit costs increase incrementally.

Also read: Banks in Singapore grapple with tepid margins in 2019

"[S]tiff competition among banks for new mortgage financing and refinancing will deter banks from raising loan rates, which will limit the upside for NIMs," Moody's said.

Low-cost current account savings account (CASA) deposits have also been shrinking as depositors shift to higher yielding fixed deposits which will further weigh on margins, Moody's said in an earlier report.

Advertise

Advertise