Singapore bank headcount up by over 4,500 in H2

Staff numbers were boosted by DBS' acquisition of ANZ staff.

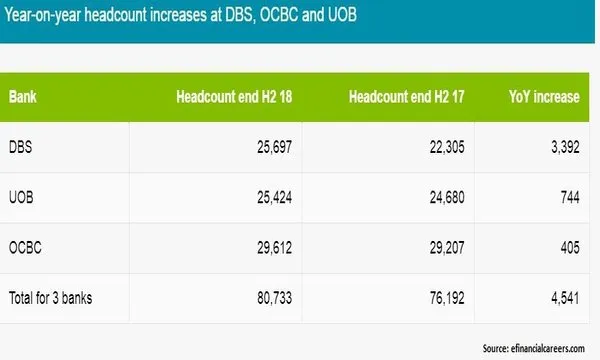

The number of staff working at Singapore's local banks - DBS, OCBC and UOB - rose by 4,541 in the second half of the year as banks ramped up tech hiring in response to the digitalisation of the financial services industry, according to efinancialcareers.

Also read: Banks are at the forefront of Singapore's upskilling charge

DBS led the pack in the largest number of staff increase in H2 after its employee pool grew by 3,392 to 25,697 after it took over the retail and wealth management business of Australian lender ANZ.

UOB staff numbers also rose by 744 to 25,424 by H2 whilst OCBC had the lowest staff increase at 405.

This makes the overall headcount at Singapore banks stand at 80,733 as of H2.

A separate report by HR consultant Randstad noted that the Lion City's retail and wealth management banks stepped up their hiring activities in Q2 expecially for relationship managers and product specialists selling bancassurance and investment products.

“Whilst banks are driving towards digitisation to replace over-the-counter service, the advisory business continues to rely on their sales force to help them attain market share,” Randstad added.

Advertise

Advertise