Regional gains boost Singapore bank loans amidst weakening domestic demand

Regional loan growth of 0.3% outpaced domestic loan expansion of 0.2%.

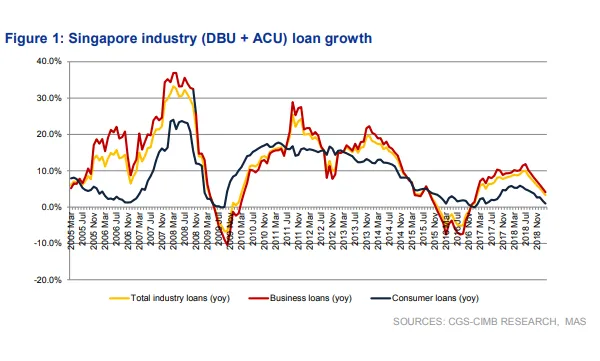

Singapore bank loans grew 0.2% MoM in February to reverse the -0.5% decline in the previous month amidst robust gains from the banks' regional footholds, according to a report from CIMB.

The growth of regional loans (0.3%) outpaced that of domestic loans which hit 0.2% in February which took a heavy hit on the consumer front. Following a lacklustre showing in the second half of 2018 (0.3%), loan growth in Hong Kong picked up pace to 1% in January. On the other hand, Malaysian loan growth slowed to -0.2% in February.

Also read: Trade tensions will not spare even the most mature APAC banks

Amongst its peers, DBS has the largest Greater China exposure at around a third of its loan book which should bode well for the bank who can expect stronger trade loan volumes through Dao Heng Bank along with OCBC Wing Hang, analyst Andrea Choong said in a report. UOB could also cash in from a displacement of supply chains out of Greater China.

"In all, we expect loan growth across banks to taper to mid-single digits (from 7-11% in FY18) as continued macroeconomic headwinds impede global growth," she added.

Advertise

Advertise