Japanese banks' loan growth to slow to 1.8% in 2019

The older population represents a shrinking client base.

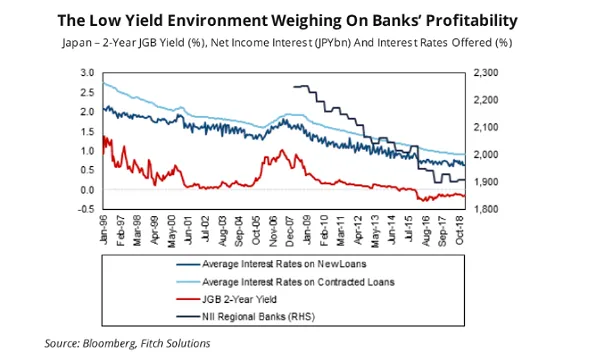

The loan portfolios of Japanese banks are set to contract even further to 1.8% in 2019 from 2.0% the previous year as the ultra-low interest rate environment continues to weigh on banks that are already struggling with a shrinking client base, according to Fitch Solutions.

"In light of these dynamics, combined with a declining population that acts as a structural factor capping loan growth, we have revised our loan growth forecast for 2019 lower to 1.8%, from 2.0%," the research firm said in a report.

As a result of the low-yield environment which has crimped on profitability, banks have been taking on more risks in their balance sheets in order to offset declining profits. Regional banks, in particular, have been lending to firms with higher credit risk profiles in an effort to eke out gains, highlighting the harsher challenges besetting banks operating outside of Japan's major cities.

Also read: Struggling Japanese regional banks go over the edge to cut losses

Such lenders generate around 85% of gross profit from net interest revenue and do not have the luxury of turning to overseas markets unlike their magabank counterparts. As a result, the share of regional banks losing money on their core businesses is expected to rise to about 60% by 2025, according to projections from the Financial Services Authority (FSA).

"We also highlight the chance of banks facing greater regulatory scrutiny in the future, which could exert additional downside pressure on loan growth," said Fitch Solutions. "Stress tests run by the central bank... showed that regional banks would be more negatively impacted at present than during the GFC, and would suffer more than internationally active banks."

The government is exploring the possibility of easing rules on regional bank consolidation, specifically on cutting down the time it takes to approve bank consolidation after it took two years and two months to clear the merger between Shinwa Bank and Eighteenth Bank.

Advertise

Advertise