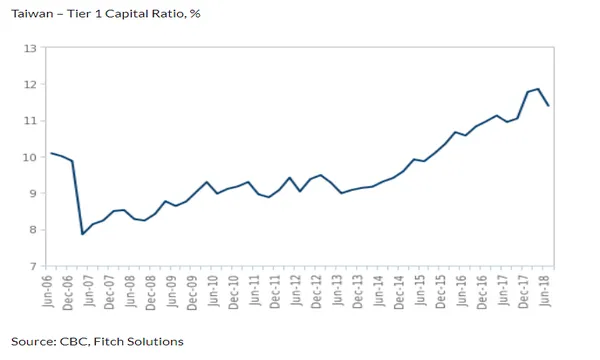

Chart of the Week: Taiwanese banks' capitalisation hit 11.4% in H1

This is above the prescribed tier 1 capital ratio of 8.5%.

The capitalisation of Taiwanese banks remained solid in the first half of 2018 which puts them in a strong position to weather the downturn brought about by the ongoing US-China trade dispute, according to Fitch Ratings.

Also read: Can Taiwanese banks keep a lid on on overseas exposure risks?

Tier 1 capital ratio rose to 11.4% in H1 2018 from 10.9% in the previous year which is well above the minimum capital requirement prescribed by the Basel III framework. The central bank prescribes that Tier 1 capital ratios of domestic banks need to at least be 8.5% from 2019 and most banks have already met the requirement.

"We believe that Taiwanese banks remain in a strong position to deal with potential shocks to the system, despite our expectations for Taiwan’s economic conditions to worsen," Fitch Ratings said in a report.

Lending, for one, is poised to receive a boost from the government's infrastructure plan and 'five plus two' innovation projects. Banks have already extended TWD199.4b in loans from January-August 2018 of the TWD200b full-year target.

Advertise

Advertise