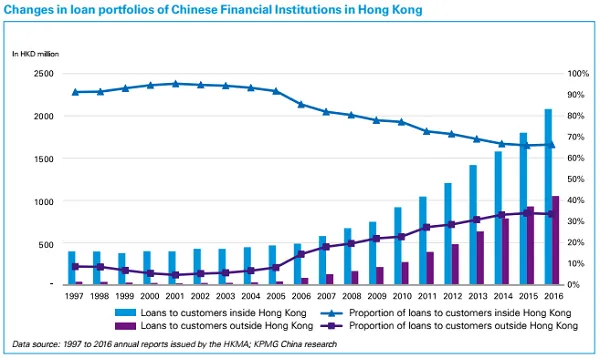

Chart of the Week: See how the loan portfolios of Chinese banks in Hong Kong changed since 1997

Their portfolios are becoming more global.

Since 1997, Hong Kong’s offshore RMB market has progressed steadily, and the size of the Chinese Financial Institutions in Hong Kong has continued to grow. KPMG said the credit balance of the Chinese Financial Institutions in Hong Kong increased by more than six times, from HKD 436b (US$55.8b) in 1997 to HKD 3,132b (US$400b) in 2016.

Here's more from KPMG:

Meanwhile, we notice that the Chinese Financial Institutions in Hong Kong’s loan portfolios are becoming more global. In 1997, the loan portfolios of the Chinese Financial Institutions in Hong Kong were mainly constrained within the Hong Kong market (91%). However, the loan investment decreased significantly to 66% in 2016.

Together with the advancement of RMB internationalisation and the establishment of Hong Kong as an offshore RMB clearing centre, the correlation between the Chinese Financial Institutions in Hong Kong and the financial institutions in mainland China will be strengthened. The trend of globalisation of the loan portfolio will become more distinct.

Advertise

Advertise