ASEAN banks' earnings slide as loan growth slows to a crawl

Indonesian banks are most at risk.

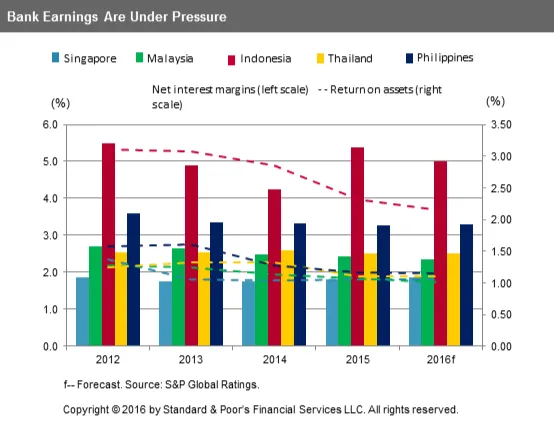

Bank earnings are under pressure on back on moderating loan growth across the region. This chart from S&P shows that banks' earnings growth will sink in 2016, in tandem with weak regional loan demand.

S&P reckons that loan growth in the Malaysian banking sector could moderate to 6%-8% in 2016, a far cry from the five-year average of 10%. Loan growth will stay fairly flat in Thailand at 5%.

Meanwhile, credit growth for Indonesian banks will likely remain at 10%-15% in 2016, with a bias toward the lower end of the range if large infrastructure projects continue to be delayed. This estimate compares with the 10% growth in 2015, and more than 20% for several years before that.

"However, Indonesia's banking sector will remain one of the most profitable banking systems globally in 2016, because, even though profitability is declining, it is coming down from a high base. We expect the Indonesian banking industry's return on assets to be 2% for 2016, a very good number by global standards," the report said.

Lastly, loan growth in the Philippines is forecasted to be 8%-12% per year in 2016. While that number is high compared with regional standards, it is a sharp adjustment from the 19% growth in 2014.

Advertise

Advertise