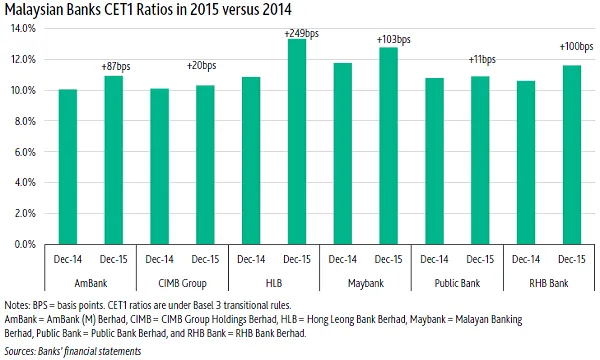

3 Malaysian banks with the largest increases in common equity Tier 1 ratios revealed

Two of them completed large rights issues in 2015.

Moody's notes of Malaysian banks that posted the largest increases in common equity Tier 1 ratios, including HLB and RHB, which completed large rights issues in 2015, as well as Maybank, which posted a modest increase in RWA.

"The higher capital buffers of the banks come at a time when operating conditions are weakening in the region. The asset quality of domestic loans has remained stable so far, while overseas loans have experienced a pronounced increase in impaired loans."

Moody's added that banks that have a greater focus on foreign lending -- such as CIMB Group and Maybank -- posted greater increases in impaired loans and impairment charges in key overseas markets, including Indonesia, Thailand (for CIMB Group only) and Hong Kong (for Maybank only). By contrast, Public Bank and Hong Leong Bank – with stronger home market bias – demonstrated more resilient asset quality metrics.

Advertise

Advertise