Here's scary proof that housing loans in Singapore banks could be bottoming out

Singapore banks better be aware.

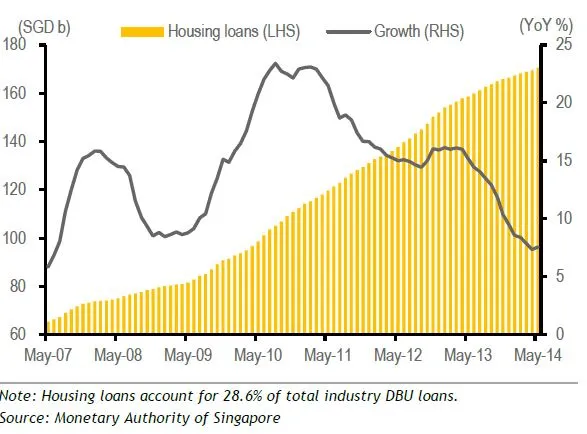

There's no stopping housing loan growth from plunging to record lows as it just hit its slowest in almost 7 years.

According to Maybank Kim Eng, business loan growth of 17.4% YoY in May continued to be the main pillar of support for industry domestic banking unit (DBU) loans (+13.0%) for the month. General commerce loans (+25.2% YoY) remained the key business loan driver.

Here's more from Maybank Kim Eng:

However, the general trend was dampened by a persistently weak housing loan growth of 7.6%, its slowest in almost seven years.

After many months of persistently weaker housing loan growth, at 7.6% YoY, growth was close to its slowest in seven years. This reflects weakening property sales and the effect of a higher base.

We expect housing loan growth to stay weak this year and next. Prospective growth will be driven by loan drawdowns from newly completed homes that were sold in 2011-2012.

Advertise

Advertise