Are Singapore banks dangerously exposed to the fallout from cascading oil prices?

The banks could be affected in an industry shakeout.

Challenging times are here for oil and gas, after having done well in recent years on strong global E&P spending.

However, the outlook on the sector is dimming, with oil prices plummeting below a sustainable investment threshold of USD80/bbl.

According to a report by Maybank Kim Eng, as oil prices may stay low in the medium term, some oil companies are considering spending cuts. Order cancellations have also been making the news.

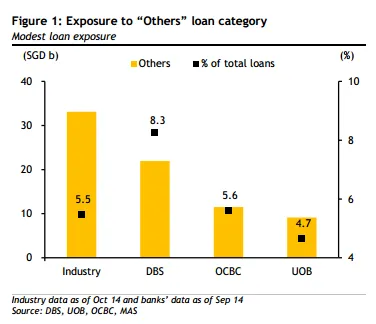

Maybank KE reveals that none of the banks under its coverage discloses its loan exposure to oil & gas. UOB’s exposure to this sector is not significant enough to warrant separate disclosure. Such loans are classified as “others”, which amounted to SGD9.1b or 4.7% of its loans as of end-September.

Here’s more from Maybank KE:

Based on broad definitions, we gather that DBS’s exposure is less than 10% of its loans. Assuming OCBC’s oil & gas loans are also lumped under others, its maximum exposure should be 5.6%.

MAS data fail to throw up further light. Its “others” loan category was SGD33.1b or 5.5% of system loans as of Oct 2014. This is inadequate as a yardstick for system exposure to oil & gas, in our view, as some oil-&-gas-related loans could have been subsumed under sectors such as transport, storage & communication (3.1% of total as of end-October) and possibly building & construction (16.7%).

Advertise

Advertise