News

Citi launches sustainable time deposit for India-based institutional clients

This is the product’s third market, after Singapore and Hong Kong.

Citi launches sustainable time deposit for India-based institutional clients

This is the product’s third market, after Singapore and Hong Kong.

HSBC plans to become top choice for VCs: report

It also plans to expand its focus to the Singapore market.

Bank of China Int'l Holdings issues first tokenised notes in Hong Kong

The product was derived from UBS, to which it marketed to its APAC clients.

SG banks strong and stable despite uncertain AT1 issuance market: experts

Banks are ramping up AT1 bond issuances after the Credit Suisse wipeout put a halt on issuances, observers said.

Kenanga Investment Bank commemorates 50 years

Clients can anticipate the Wealth SuperApp launch.

UOB outlook stable despite muted operations: Moody’s

Its recent acquisition will contribute positively to profitability.

Malaysia's AmBank, Alp Capital unveil point-of-sale QR payment for retailers

The new feature reduces the time spent reconciling transactions and e-wallet payments separately.

StanChart, SMU establish programme for women entrepreneurs

The bank funded $300,000 for the incubator.

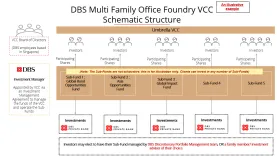

DBS launches multi family office platform

The bank is already in talks with over 20 clients and prospects across Asia.

UBS, Credit Suisse SG operations "uninterrupted" post-acquisition: MAS

Both banks will operate on separate licences in Singapore.

40% of APAC susceptible to scam, youth more vulnerable: Visa

The youth are 1.3 times more likely than older adults to have been victimised by scams.

UOB opens 10th FDI Advisory Centre in Japan

Since its launch, the advisory unit supported about 4,000 companies investing in the region.

Nearly 9 in 10 SEA people now have access to credit

The report delves deeper into the effects of credit access on financial services provider (FSP) customers.

Aggressive loan growth leaves HDBank more vulnerable to risks

Its asset quality may be further strained by its planned acquisition of a ‘weak’ bank

CIMB reaps benefits from de-risking, cost optimisation initiatives

Net interest margin compression will be offset by improved profits and stable capital.

OCBC to remain strong and stable through 2024: Moody’s

Asset quality and nonperforming loans will likely remain between 1% to 1.5% in 2023-2024.

Hang Seng Bank to launch RMB counter on 19 June

The bank’s shares will be designated as dual counter securities by the stock exchange.

Advertise

Advertise