News

How will the slowing buildup in corporate leverage affect Asia Pacific banks?

Deleveraging efforts increases risks to banks' asset quality.

Vietnam banks' NPL ratio reaches 9%

The 2.4% NPL ratio reported at end-2015 was understated.

Thai banks' asset quality continues to weaken

Risks are prevalent in the SME and unsecured retail loans segments.

Will Asia Pacific regulators be keen to embrace wider bail-in measures?

Banks could expect greater government support in 2017.

Chinese banks struggling with heightened risks

No thanks to the shadow banking system having assets equal to 82% of GDP.

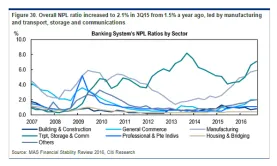

Chart of the Week: Check out the Singapore banks' NPL ratios by sector

Overall NPL ratio increased to 2.1%, led by manufacturing, and transport, storage and communications.

Weekly Global News Wrap Up: Wells Fargo punished for failing 'living will' test; SWIFT remains at risk of cyber attacks

And UniCredit to raise US$13.8b and shed 14,000 jobs.

Global Islamic banking assets reached US$924b in 2015

Guess which country has the largest market share.

Singapore banks to be affected by modestly higher risk-weight charges in 2017

But capitalisation remains stable.

There's nothing to worry about Philippine banks' liquidity in 2017: Fitch

The low aggregate loan-to-deposit ratio of 71% is proof.

Indonesian banks' profitability metrics declining steadily since 2013

Return-on-assets will remain flat at 2%.

Indian banks to require US$90b in new capital by March 2019

Half of it will have to be met through core equity.

3 factors that will cause Hong Kong banks' profits to decline

Subdued loan growth is one.

Taiwanese banks' mainland China exposure down to 6.2% in 2Q16

It reduces the risks from deleveraging spilling over into Taiwan.

Australian banks' asset quality metrics to come under further pressure

But funding profiles continue to improve.

Bangkok Bank CEO hopes Thailand's NPL ratio won't peak at 4%

But analysts think this scenario is "too pessimistic".

Advertise

Advertise