News

Australian banking sector to come under review

It will be lead by King & Wood Mallesons partner Scott Farrell.

Australian banking sector to come under review

It will be lead by King & Wood Mallesons partner Scott Farrell.

China banks' assets up 11.4% to $35.04t as of end-June

Liabilities also rose 11.3%.

Here's why growth in Islamic banking will slow in the coming years

The slump in oil prices is one factor.

Higher SIBOR to spur growth in Singapore banks' interest income

At the end of June, 3-month SIBOR has risen to 1.115%.

China commits to tighten financial regulatory oversight

The current fragmented framework makes it more difficult for regulators to monitor banks.

Weekly Global News Wrap Up: Bank merger boom set to begin; New accounting rules for banks to worsen crises

JPMorgan records most profitable year and Credit Suisse ends cost-cutting era.

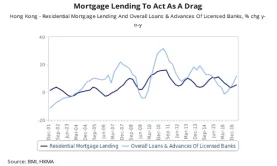

Chart of the Week: Hong Kong banks' mortgage lending to slow

Rising interest rates are to blame.

Aussie banks face 100bps increase in Tier-1 capital

The aim is for them to be 'unquestionably strong'.

What could boost growth of the Malaysian Islamic banking sector?

The country has US$150b in Islamic financial assets.

Small Thai banks to outperform big banks as NPLs improve

Loan growth should accelerate in the second half of 2017.

Everything you need to know about Vietnamese banks' improving asset quality

Impaired loans decreased from 12.7% to 8.4% of total loans in 2016.

Three in five banks report trade finance shortage in the global market

The estimated trade finance gap stands at US$1.6t.

How does China's move to curb shadow banking affect banks?

The measures benefit the banks but also bring adjustment risks.

Weekly Global News Wrap Up: Will banks leave London post-Brexit?; New US rule makes it easier for customers to sue banks

And find out why the new EU banking regulations are a 'headache'.

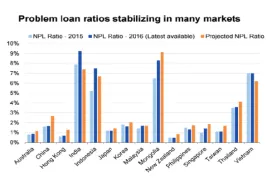

Chart of the Week: Asia Pacific banks' problem loan ratios stabilising

Asset quality risks are receding in most markets.

Competition amongst smaller Islamic banks set to intensify

That is if the Malaysia Building Society-Asian Finance merger will push through.

Asia Pacific banks' cyclical pressures finally easing

But high private sector debt still a key risk.

Advertise

Advertise