News

Singapore's circuit breaker spells downturn in loan growth

Consumer loans were mostly affected, shrinking 0.9% MoM, OCBC said.

Singapore's circuit breaker spells downturn in loan growth

Consumer loans were mostly affected, shrinking 0.9% MoM, OCBC said.

India may inject almost $20b into state-owned banks

A final decision could be made in H2 of India’s fiscal year.

Singapore big three's total dividends to decline 3.1% in 2020

UOB is expected to suspend its special dividend for the fiscal year.

Hong Kong finance firms lead in AI deployment

58% of financial firms in the city will utilise AI next year.

Stable playing field a gain for Singapore banks: report

High credit costs can be covered by profits.

Asian banks face consolidation as fintechs, neobanks usurp market

Banks’ hopes for survival lie in the US$100b of new revenue opportunities, reports McKinsey & Co.

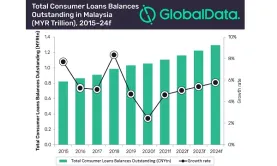

Chart of the Week: Malaysia's consumer loan growth to decelerate in 2020

There’s just little banks can do to encourage people to take out loans.

Weekly Global News Wrap: UBS to inject millions into fintechs; Deutsche Bank chair to bow out after 2022

And two Canadian banks post better than expected results despite profit declines.

HSBC sees significant growth in new APAC wealth arm

Double-digit growth is on the horizon over the next three years.

COVID-19 accelerates digital payments adoption in South Korea

The country’s credit card issuers are seeing a rise in credit card use for online purchases.

Chinese banks' volatile results posit hazy future for 2020

City commercial lenders’ profits followed a “V” curve from 2017-2019.

Japan's MUFG to shutter 40% of local branches by 2023

It also expects 6,000 job losses by that year.

Weekly Global News Wrap: JPMorgan gives out $30b in loans for US SMEs; Citi pilots ESG unit

And Westpac admits to money laundering breaches.

Singapore allows finance firms to reopen select locations starting 2 June

But most staff will continue to work from home.

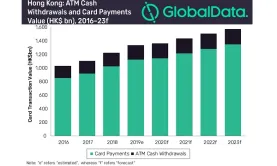

Chart of the Week: COVID-19 to drive digital payments take-up in Hong Kong

E-payments firm Octopus said that mobile wallet usage rose 30% in February.

Chinese central bank should dodge bond buying: adviser

It could lead to inflation and the depreciation of the yuan.

Japanese major banks' lending surge 3.4% in April

Borrowings by COVID-hit firms spurred the jump.

Advertise

Advertise