News

Korean banks to ease lending standards for companies and mortgages

But banks are expected to tighten lending standards for household loans.

Korean banks to ease lending standards for companies and mortgages

But banks are expected to tighten lending standards for household loans.

Malaysia warns against four unauthorised companies

They have similar names to companies authorised by BNM but are not related to them.

Alliance Bank lowers fixed deposit rates

The counter rate for 1-month fixed deposits is now just 2.65% from 2.75%.

Weekly Global News Wrap: ECB raises concerns over UniCredit’s high turnover; China warns banks against “one-sided” credit pursuit

And two JP Morgan & Chase top dealmakers are reportedly leaving the bank.

Hong Kong launches new credit reference operating model

Credit Data Smart will guide the collection of credit as future reference to loan providers.

Ant International to build Malaysia digital business centre and is hiring 500 roles

The centre is expected to move in at The Exchange 106 by 2025.

HK-based fintech KPay expands operations to Singapore

The firm plans to triple its merchant base in Singapore to over 10,000.

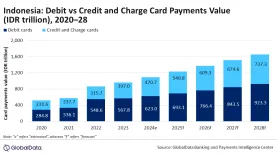

Chart of the Week: Indonesia’s card payments market to be worth $71.8b by end-2024

But point-of-sales terminal penetration remains low.

Thailand’s Krungthai Bank temporarily closes two branches

They will resume normal operations on 22 April.

DBS and OCBC expected to deliver steady Q1 net profits

Their net interest margins will ease as a result of their Hong Kong loans.

Taiwan’s Hua Nan’s asset quality to remain sound through 2025

Loans to SMEs and the property sector have improved, says Moody’s.

Property malaise weighs on China and Korean banks

Most of APAC banks have a stable outlook for 2024, says S&P.

India floats regulations for non-bank POS payment aggregators

They are required to apply authorisation from the RBI by May 2025.

Robust employment, stable housing market anchors CUB’s profits

But net interest margin will likely stay flat or contract mildly.

China boosts financial services to advance new industrialisation

Insurance funds should provide long-term stable financial support.

Mebuki's profits to improve but unrealised losses to rise

Its problem loans ratio is stable due to strong borrower quality.

Why tokenization and funding are two key issues for financial disruptors in 2024

HSBC's Vincent Lau a lineup of 250 speakers to discuss these at Money 20/20 Asia.

Advertise

Advertise