Hang Seng enables credit card customers to use loyalty points in AlipayHK

They can use their loyalty points to pay at over 150,000 outlets that accept AlipayHK payments.

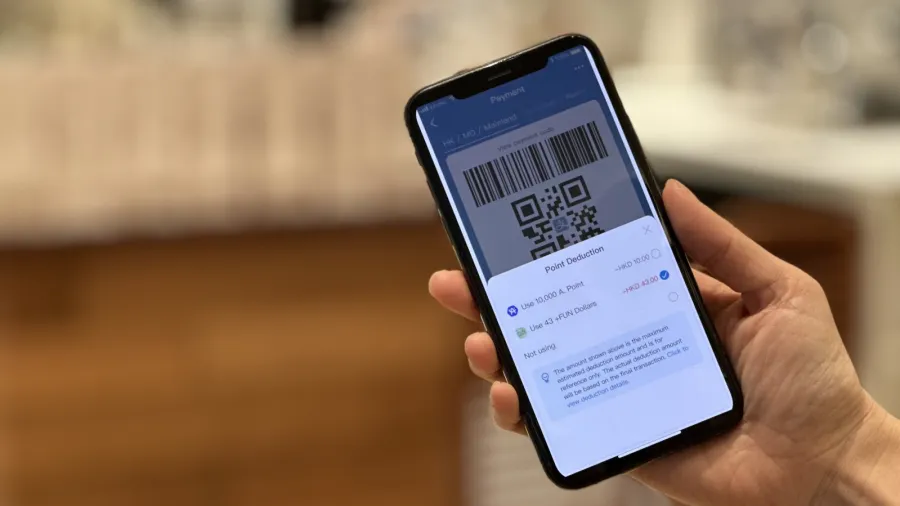

Hang Seng Bank customers can now make payments using +FUN Dollars via AlipayHK when they link their credit card with the payments app.

This positions Hang Seng as the first bank in Hong Kong to offer credit card loyalty point redemption through AlipayHK, the bank said in a press release. With this, Hang Seng’s credit card users can now use their loyalty points to pay at over 150,000 local retail outlets that accept AlipayHK payments.

ALSO READ: Krungsri launches cross-border QR payments to Hong Kong

Hang Seng’s head of wealth and personal banking, Rannie Lee, said that the new service enhances the value of their credit card customers’ loyalty points and benefits for daily transactions.

“This major breakthrough to our credit card rewards programme exemplifies Hang Seng’s ‘future banking’ service concept commitment and to delivering a more rewarding and seamless banking experience,” Lee added.

Advertise

Advertise