Taiwan

Renminbi-denominated deposits in Taiwan fall in June

First monthly drop since OBU scheme began July 2011.

Renminbi-denominated deposits in Taiwan fall in June

First monthly drop since OBU scheme began July 2011.

Chinatrust Commercial Bank changes English name

Is now known as CTBC Financial Holding Company.

Taiwan banks could issue renminbi loans in Xiamen

China intends to boost renminbi flows between Xiamen and Taiwan.

Taiwan, China agree to beef-up banking management pool

Sign a cooperation agreement on cultivating and training financial talent.

Taiwan boosts position as offshore renminbi hub

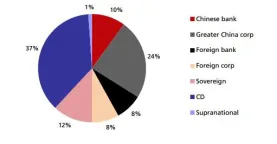

Deutsche Bank becomes first foreign bank to raise renminbi in Taiwan.

Taiwan identifies top state-owned banks

First Commercial Bank is ranked first.

What you must know about financial reforms in Taiwan

Financial reform is part of political reform and looks like to be a continuous effort of Taiwanese government. However, the idea disclosed by its Finance Minister on the local newspaper recently encouraging a kind of "public to public banks merge" seems debatable.

Taiwan’s FSC concerned about new business tax

Says it would cut weak profits in an unfavorable economic environment.

Exploring financial accessibility for SMEs

According to ADB's recent news release showing that a gap of some USD 425 billion between importers and exporters among developing countries is to be facilitated in 2011.

Taiwan becoming a local hub for RMB settlement and trading

Two days before the Singapore's announcement, financial institutions in Taiwan formally launched their RMB business after signing currency clearing agreements with Bank of China's Taipei branch.

Direct bank trading of renminbi and Australian dollar imminent

Test run of direct trading at banks currently ongoing.

China-Taiwan banking consultations continue

China said talks with Taiwan should produce “good results”.

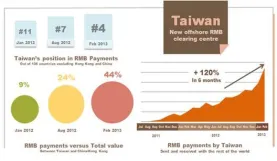

Taiwan now the world's fourth largest RMB offshore centre, beating US and Australia

RMB payments surged 120% over the last six months.

Renminbi deposits in Taiwanese banks reach US$2.08 billion

Taiwan’s 53 domestic banking units began trading only last February 6.

It's high-time to use more credit insurance to support trade finance

During Chinese New Year, I visited a friend working for the Exim Bank of Taiwan (EBT), the only export credit agency(ECA) in Taiwan set up in 1979, I was advised with joy that business turnover of the Bank has passed TWD90billion (aroundUSD3 billion) in 2012 and will be easily over TWD100billion (around USD3.33 billion)this year. He is so happy because the growth rate is almost ten folds compared to ten years ago . However, knowing that total turnover of Sinosure, EBT's counterpart in China set up in 200, was up 35% from previous year to USD293.6billion in 2012 and the percentage of export coverage for China is more than 10% while EBT's % of coverage is less than 1% during the same period, he has to admit that EBT has plenty room to improve. From study, I found out that the difference between the two institutions is the marketing strategy. EBT is selling policy without financing but Sinosure is selling through banks which are providing trade finance. Similar practice was experienced by Coface in China through its strategic partner, Pin-An Insurance, to support banks' clients to obtain trade finance. Other private credit insurance companies such as Euler-Hermes, Atradius, and Chartis...etc. are also growing and compete seriously with each other since financial crisis in 2008. The product is formally available only for large enterprises but many banks are using it to support supplying chain finance, factoring, and invoice discount..etc. for SMEs clients recently.

Taiwan Financial counting on yuan business for expansion

Taiwan Financial aims to accelerate its Asia-Pacific expansion and increase profit from overseas operations.

Fubon Financial tops peers in earnings

Fubon Financial credits its wealth management products for its net income of NT$4.04 billion last month.

Advertise

Advertise