Malaysia

Malaysia, Kuwait to train Islamic banking professionals

Will jointly develop training and internship programs.

Malaysia, Kuwait to train Islamic banking professionals

Will jointly develop training and internship programs.

Maybank sells 9% stake in PT Bank Internasional Indonesia

Stake sold to an undisclosed third party investor.

It’s final: no deal for CIMB and San Miguel

Malaysia’s CIMB Group no longer interested in owning Bank of Commerce.

CIMB skills up Malaysian graduates with 6 partners

CIMB pioneers human capital development programme.

Maybank names Mohamed Rafique Merican officer-in-charge pending appointment of new CEO

Maybank announced that Encik Mohamed Rafique Merican Mohd Wahiduddin Merican has been appointed as Officer-in-Charge of the Bank effective 5 June 2013. Rafique will oversee the overall running of the day-to-day operations of the Maybank Group until the appointment of a President & CEO to succeed Dato’ Sri Abdul Wahid Omar, whose appointment as Minister in the Prime Minister’s Department will also become effective on the same day.

CIMB and Deutsche Bank complete placement of 50m existing shares in Tenaga

That's 0.9% of its paid up share capital.

Islamic trade finance predicted to be the preferred choice in emerging markets

These markets include Indonesia and Malaysia.

CIMB intent on buying Philippine bank

CIMB's acquiring a 60% stake in Bank of Commerce.

RHB and OSK complete merger

RHB Holdings Hong Kong is now a member of the RHB Banking Group.

CIMB signs MOU with the Institute of Bankers Malaysia

42,000 employees will benefit from the MOU.

The APAC SME Banking Conference rolls out in Malaysia

It will be held on 15th and 16th May 2013.

CIMB focuses on equities for growth

This is part of its plan to become a leading pan-Asian investment bank.

CIMB begins investment banking in India

CIMB now in all major APAC markets except Taiwan.

OCBC Al-Amin reaching out through Xpres branches

Islamic Banking is gaining popularity among not only Muslims but non-Muslims as well in Asia. On its part, OCBC Bank sees this as an opportunity to offer an even broader array of competitive and innovative financial products and services to consumers and businesses. And it recently started doing so through the Xpres branches of its Islamic banking subsidiary, marking a milestone in the four-year journey of OCBC Al-Amin Bank Berhad.

The impact of currency appreciation on trade performance in Asia

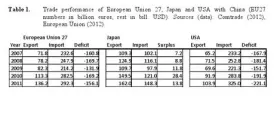

For a long period of time, Yuan’s exchange rate has been on the agenda in the large trade deficit regions, such as the U.S.A. and Europe (see Table 1). The U.S.A. has been arguing for long time that China has kept currency valuations at artificially low levels, favoring Chinese manufacturing exports harming this way the manufacturing industry in the U.S.A.

Maybank eyes issuing 150,000 Maybankard Visa Superman Debit card

That is only within two months of its launch.

Hong Leong Bank appoints Galvin Yeo as head of digital banking

Yeo has nearly 20 years of experience.

Advertise

Advertise